0

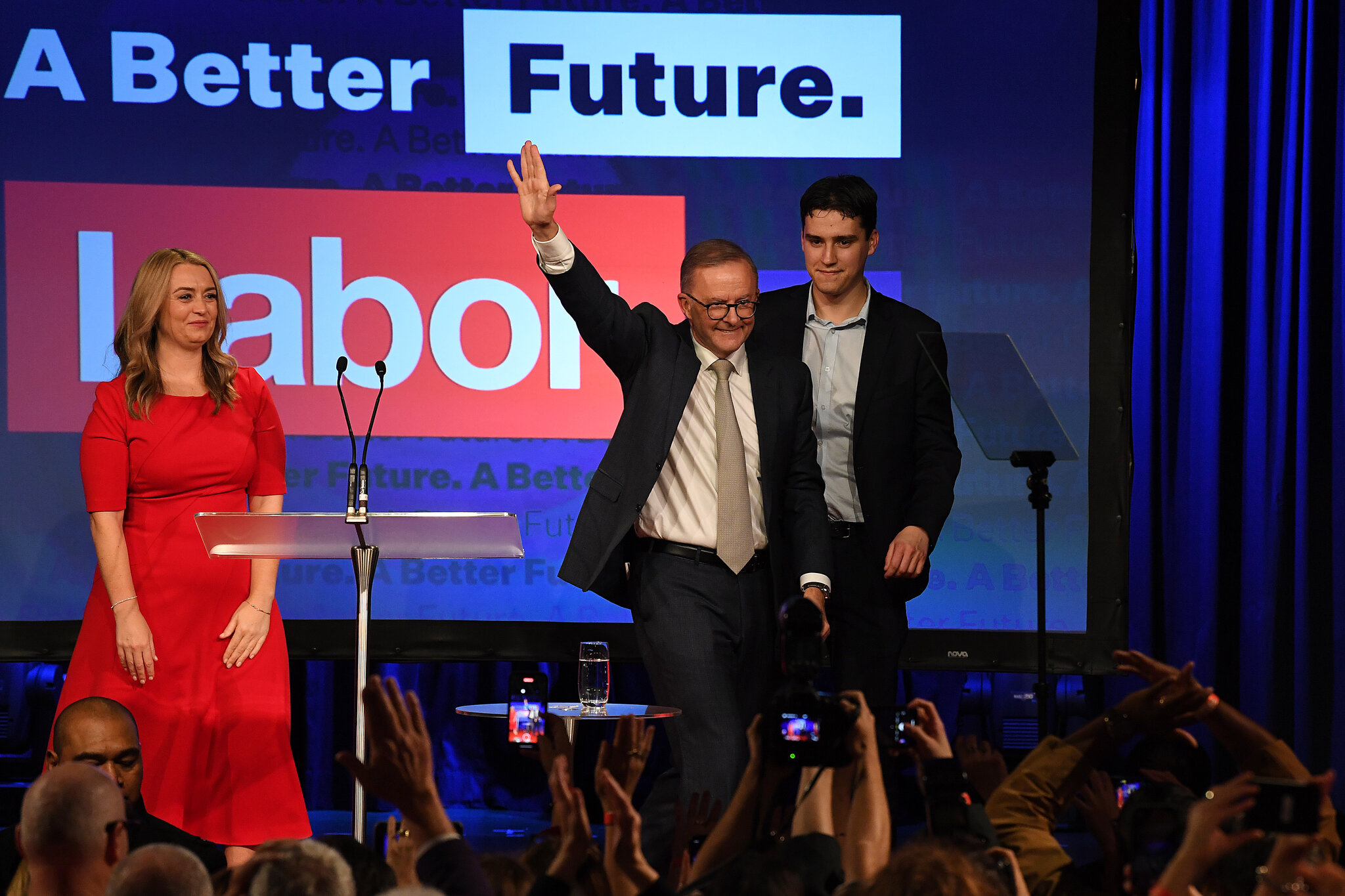

Australian equities retreated Monday despite a historic political milestone, as Prime Minister Anthony Albanese secured a rare second term — the first consecutive re-election of a sitting Australian leader in more than two decades. The market’s muted reaction underscores investor caution amid global economic uncertainties and light regional trading volumes due to multiple public holidays across Asia.

The S&P/ASX 200 index dropped 0.83%, pulling back from Friday’s high — its best close since late February — as traders digested the implications of political continuity and a shifting international landscape. While Albanese’s win signals voter support for stability, analysts noted that markets may be bracing for potential policy recalibrations or delays in reforms ahead.

Meanwhile, the Australian dollar edged 0.33% higher against the U.S. dollar, trading at 0.6462. Currency markets generally reflected a subdued but positive sentiment towards Albanese’s re-election and its implications for macroeconomic continuity.

Broader regional activity was subdued with markets in Japan, South Korea, Hong Kong, and mainland China closed for public holidays. However, in Taiwan, the Taiex index slipped 1.31% amid volatile trading, even as the New Taiwanese dollar strengthened sharply — appreciating 3.14% to 29.741 against the greenback, reaching its highest level in nearly three years.

China’s offshore yuan also saw modest gains, rising slightly to 7.206 per dollar, with earlier session movements marking its strongest level since November 2024.

In commodities, oil prices dropped sharply after the OPEC+ alliance announced plans to increase output for a second consecutive month. Brent crude futures fell 3.62% to $59.07 a barrel, while West Texas Intermediate crude declined nearly 4% to $56.00, as concerns over potential oversupply pressured prices lower.

U.S. equity futures pointed slightly downward in early Asian hours, suggesting a pause after a week of robust gains on Wall Street. On Friday, the S&P 500 advanced 1.47% to close at 5,686.67, notching its ninth straight day of gains — the longest winning streak since November 2004 — and fully rebounding from losses tied to renewed tariff threats earlier in April.

The Dow Jones Industrial Average surged 564 points to finish at 41,317.43, while the Nasdaq Composite rose 1.51% to 17,977.73, driven by tech optimism and easing rate expectations.

While Australia’s political scene has settled, financial markets are likely to remain sensitive to global cues — particularly upcoming central bank decisions, trade tensions, and energy dynamics — as investors weigh the resilience of the post-pandemic recovery.

Disclaimer: The information contained herein (1) is proprietary to BCR and/or its content providers; (2) may not be copied or distributed; (3) is not warranted to be accurate, complete or timely; and, (4) does not constitute advice or a recommendation by BCR or its content providers in respect of the investment in financial instruments. Neither BCR or its content providers are responsible for any damages or losses arising from any use of this information. Past performance is no guarantee of future results.

More Coverage

Risk Disclosure:Derivatives are traded over-the-counter on margin, which means they carry a high level of risk and there is a possibility you could lose all of your investment. These products are not suitable for all investors. Please ensure you fully understand the risks and carefully consider your financial situation and trading experience before trading. Seek independent financial advice if necessary before opening an account with BCR.