0

US Dollar Index

The US dollar started the week with a bearish trend, but price action remains trapped within its previous range, highlighting market hesitation as investors wait and see ahead of the Federal Reserve's decision. The US Dollar Index hovered around 97.60, near a ten-week low. At the European open, the index was virtually flat at 97.50, with bearish sentiment capped above 97.50. Upside attempts have been limited to 97.70 so far, down from Friday's high of 97.80. Investors are awaiting the Federal Reserve's highly anticipated policy meeting this week. Markets are pricing in a roughly 96% probability of a 25 basis point rate cut on Wednesday, with a roughly 4% probability of a larger half-percentage point. These bets are based on recent US data showing a weak labor market and tame inflation. Elsewhere, the central banks of Canada and China are expected to cut interest rates this week, while policymakers in Japan and the UK are likely to hold steady.

The near-term technical picture remains bearish. The 14-day relative strength index (RSI) on the daily chart remains below 50, suggesting potential selling pressure on rallies. Recent price action has shown a descending channel since the August 5 high, supporting a bearish view. The recent USD rebound has encountered resistance at the 34-day simple moving average (SMA) at 98.24, and at 98.32 (the 50.0% Fibonacci retracement level from 96.38 to 100.26). A break above this level would confirm a trend reversal and lead to a test of the 100-day SMA at 98.60. On the downside, immediate support lies at last week's low of 97.25, followed by key support at 97.11 (the July 24 low) and the -97.00 (round-number mark). Further downside, the July 4 and 7 lows, near 96.90, will become key levels of concern.

Consider shorting the US Dollar Index at 97.45 today, with a stop-loss at 97.58 and a target of 97.10 or 97.0.

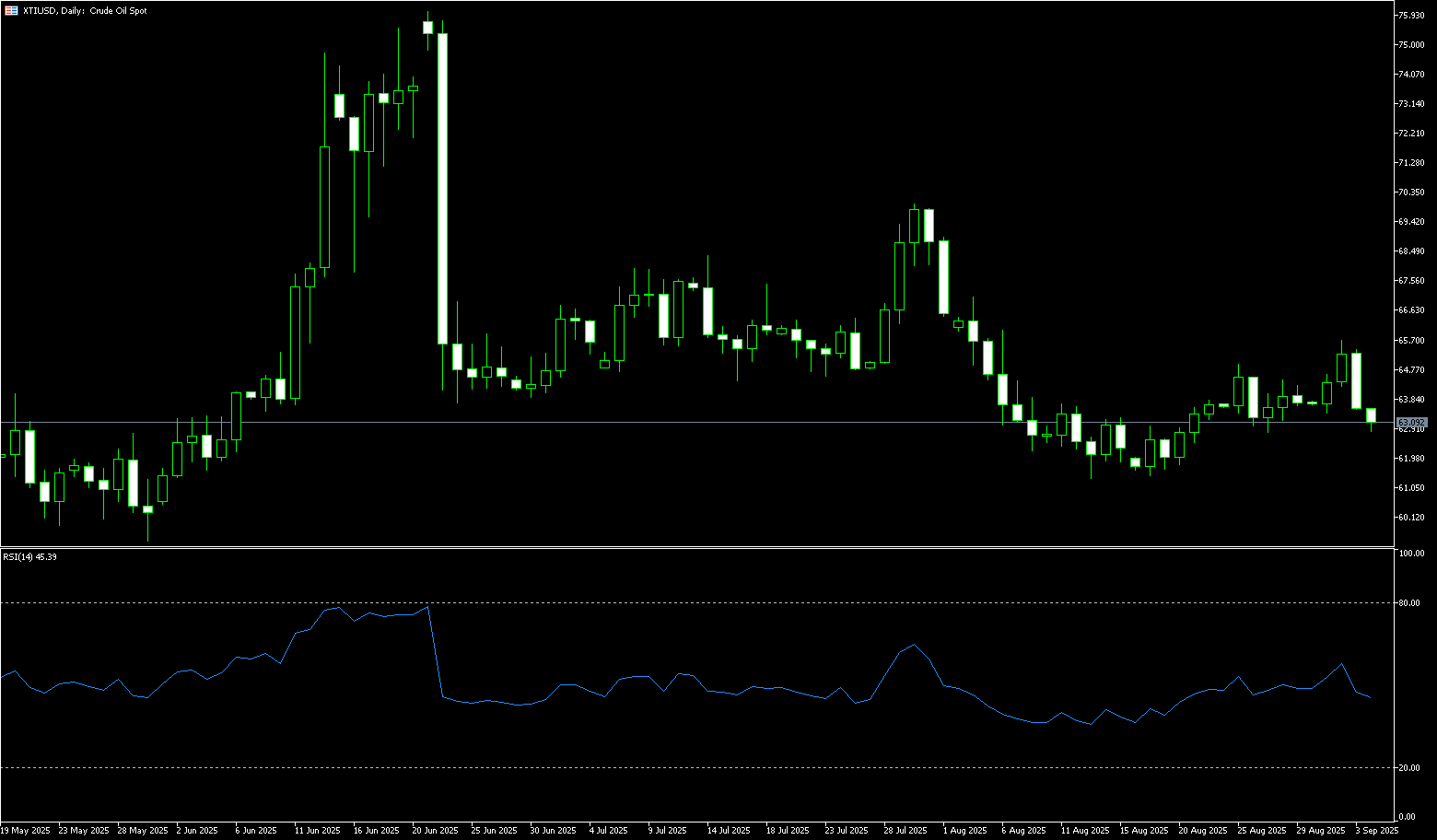

WTI Spot Crude Oil

WTI crude oil rose to $63.00 per barrel on Monday, primarily due to concerns about Russian crude oil supplies, Ukraine's intensified attacks on energy infrastructure, and stalled peace talks, which heightened the risk of further Western sanctions. Over the weekend, Ukraine launched a large-scale attack on Russia's Chirich refinery, one of Russia's three largest, with a daily production capacity of approximately 355,000 barrels. Furthermore, US President Donald Trump reiterated his call for Europe to halt purchases of Russian oil, having previously stated that he would be prepared to impose significant sanctions on Russia if NATO countries took similar action. However, slowing US demand and the risk of a global oversupply caused by OPEC+ production increases limited crude oil price gains.

WTI crude oil broke out earlier this week, and its rebound is currently capped by its 20-day simple moving average at $63.22 and last week's high at $63.78. The MACD technical indicator suggests that short-term momentum may be transitioning from "advance" to "consolidation." The 14-day Relative Strength Index (RSI) is at 45, in negative territory, indicating technical weakness. The probability of a short-term pullback after a short-term surge is high. If oil prices adjust downward again, targets include $62.00 (round number), and $60.78 (June 2 low). A firm close above $62.00 would likely shift the market tone to a bullish note. Traders are currently focusing on the 20-day simple moving average at $63.22, resistance at $63.78 (last week's high), and $64.00. If oil prices can sustainably break through the above resistance, further upside potential is likely. Subsequent resistance is concentrated at $65.61 (the 50.0% Fibonacci retracement level from $70.02 to $61.20).

Consider going long on crude oil at $62.85 today. Stop-loss: $62.70. Target: $64.50, $64.80.

Spot Gold

Gold reached an all-time high of $3,685.50 per ounce on Monday as a weaker dollar and falling Treasury yields boosted demand for the metal. Markets are gearing up for this week's crucial Federal Reserve meeting, where policymakers are expected to implement the first interest rate cut since December on Wednesday, by at least 25 basis points. This decision comes as officials weigh the cooling labor market against tariff-driven inflationary pressures, while also considering ongoing concerns about the Federal Reserve's independence. Updated FOMC projections are also expected to hint at one or two more rate cuts before the end of the year. Investors will closely monitor U.S. retail sales and industrial production data released on Tuesday for fresh clues about the economy's resilience. Meanwhile, the U.S.-China trade talks, which began in Madrid on Sunday, remain in the spotlight as global trade tensions continue to weigh on market sentiment.

Gold has risen for the sixth time in seven weeks, breaking all-time highs. Overall, the gold market remains strong, supported by multiple positive factors. The Federal Reserve's interest rate decision will be a key near-term catalyst, determining whether gold prices can reach new highs. However, investors should be wary of technical pullbacks and shifts in market sentiment. Gold's upward trajectory is not without resistance, especially given the already historically high price. Bulls' next upside target is to push gold prices above last week's all-time high resistance of $3,700.00. Bears' immediate downside target is to push gold prices below key technical support at $3,555.00 (the 14-day simple moving average). First resistance is seen at $3,685.00 (this week's all-time high), with further resistance at the round-figure high of $3,700. First support is seen at the overnight low of $3,600 (a psychological level), with further support at $3,555.00 (the 14-day simple moving average).

Consider going long on gold at $3,673 today, with a stop-loss at $3,669 and targets at $3,690 and $3,700.

AUD/USD

The Australian dollar rose to around $0.6674 on Monday, extending last week's gains, following weakness in the US dollar and anticipation of the FOMC policy decision later this week. The market currently sees a 96% probability of a 25 basis point rate cut on Wednesday, with only a 4% chance of a larger 50 basis point cut. Domestically, Australia's economic calendar this week is relatively light. However, investors' focus is shifting to the upcoming jobs report and speeches by Reserve Bank of Australia officials, which may shed further light on the central bank's policy trajectory. Last week, Reserve Bank of Australia (RBA) Governor Michelle Bullock highlighted encouraging signs of "slightly more growth" in the private sector, describing it as a positive sign for the broader economy. Her remarks reinforced the RBA's cautious stance and supported market expectations that the central bank will maintain interest rates at its policy meeting at the end of this month.

AUD/USD traded around 0.6668 on Monday. Technical analysis on the daily chart shows that the pair has continued its upward trend after breaking above the psychological 0.6600 level, indicating a bullish market bias. Furthermore, the pair is above its 9-day simple moving average at 0.6597, suggesting strong short-term price momentum. On the upside, the pair could approach the 11-month high of 0.6687 reached in November 2024, followed by the upper line of the ascending channel near 0.6700. A break below this level would directly target 0.6742 (the high of October 10, 2024). Initial support lies at the psychological market level of 0.6600 and the 9-day simple moving average at 0.6597, followed by the lower line of the ascending channel at 0.6570 and the 14-day simple moving average near 0.6573.

Today, consider a long position on the Australian dollar at 0.6655, with a stop-loss at 0.6645 and targets at 0.6700 and 0.6710.

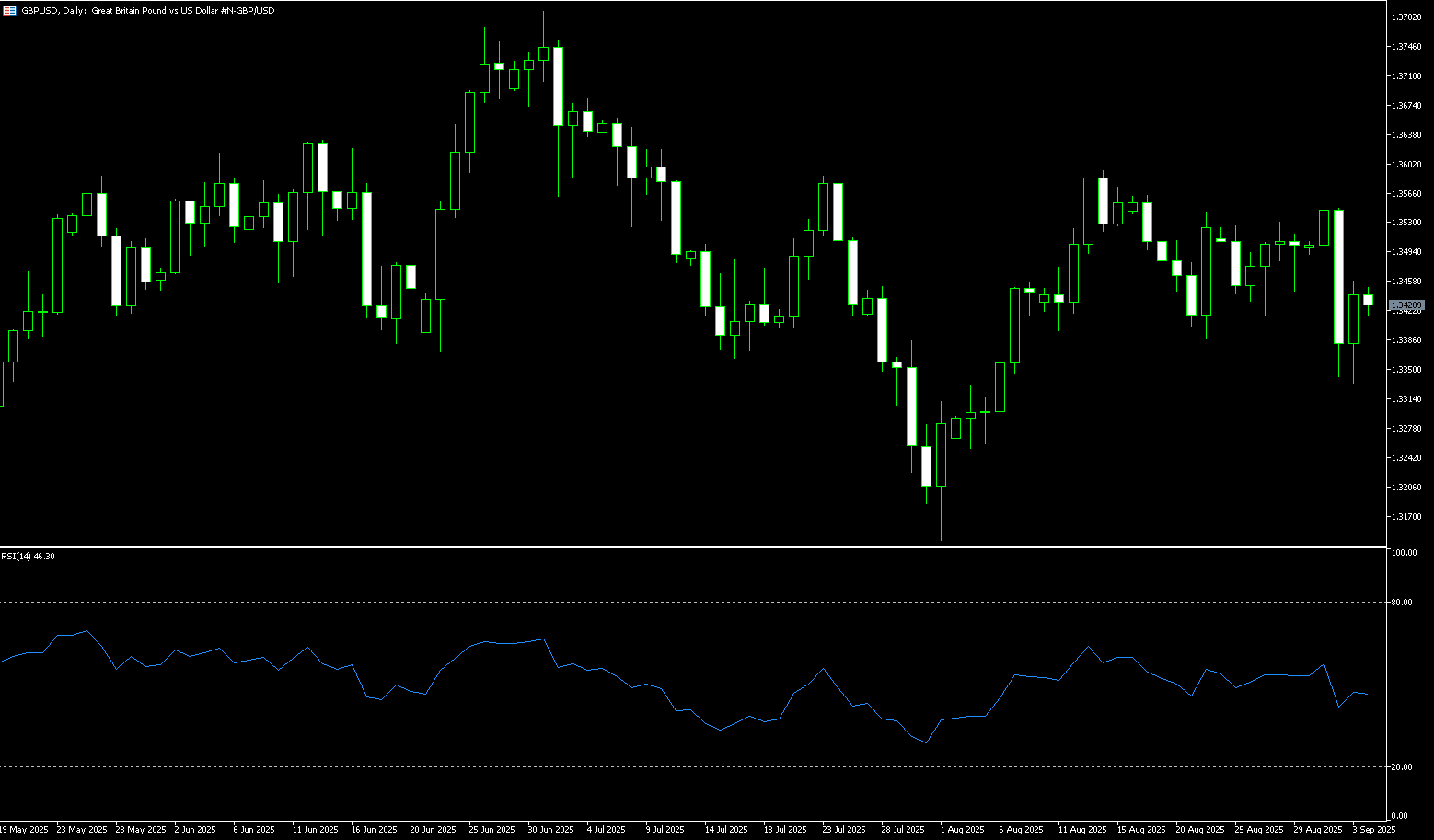

GBP/USD

The British pound rose against the US dollar at the start of the European trading session, with GBP/USD rising above 1.3600, a high not seen since July. The US dollar traded cautiously as investors awaited monetary policy announcements from the Federal Reserve and the Bank of England on Wednesday and Thursday, respectively. Traders expect the Federal Reserve to announce its first interest rate cut of the year at its policy meeting on Wednesday, which could put pressure on the dollar. Bets strongly favor a rate cut at the Fed's September meeting on Wednesday, with recent evidence of labor market weakness further bolstering expectations. Federal Reserve officials, including Chairman Jerome Powell, have made it clear that future policy decisions will be data-dependent. Any dovish comments from the Fed could put pressure on the US dollar and provide support for the currency pair. On the other hand, weak UK GDP and manufacturing data for July could exert some selling pressure on the British pound.

The daily chart shows that GBP/USD continues to challenge the strong psychological resistance level of 1.3600, while the 14-day relative strength index (RSI) remains firmly above its midline. However, the confirmation of a death cross casts doubt on further gains. Immediate support lies at 1.3544 (the 20-day simple moving average) and 1.3548 (last Friday's low). A break below these levels would test last week's low of 1.3500. A sustained break below the latter would initiate a new downtrend. Conversely, 1.3600 will be the next focus for bulls, followed by 1.3681, the July 4 high, and the 1.3700 round number. A break below this level could lead to a move towards 1.3788 (July 1 high).

Consider a long GBP at 1.3588 today, with a stop-loss at 1.3575 and targets at 1.3640 and 1.3650.

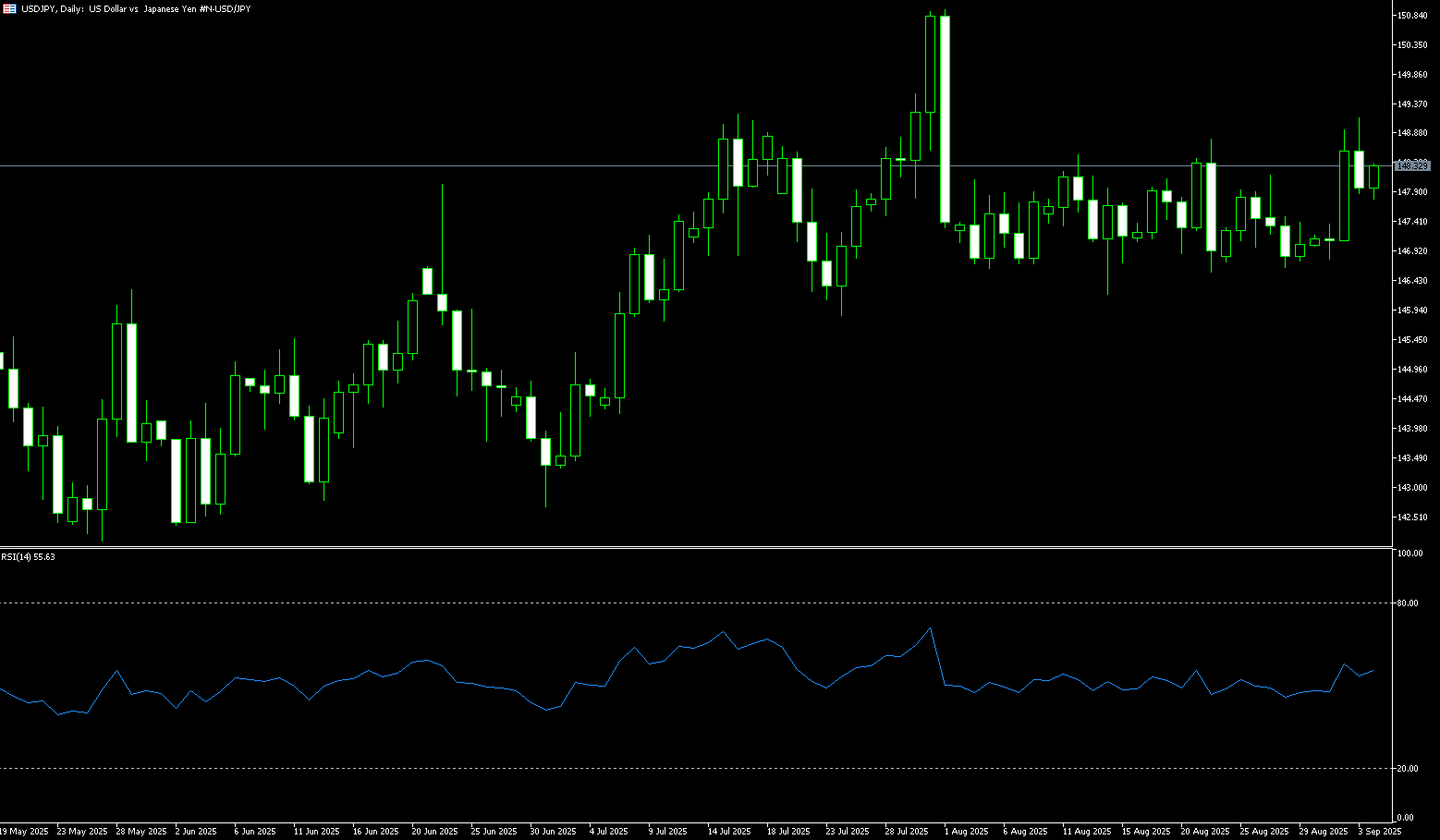

USD/JPY

The yen appreciated to around 147.30 against the dollar on Monday, partially recovering last week's losses, as market focus shifted to the Bank of Japan's policy meeting. The BOJ is expected to hold interest rates at 0.5%, as officials weigh domestic headwinds and global risks, including the impact of US tariffs. Traders also await the latest trade data, with both exports and imports expected to remain sluggish, as well as inflation data, with the core CPI expected to slow to 2.7%, the lowest level since November 2014. Externally, the Federal Reserve is expected to cut interest rates by 25 basis points this week, following recent US data that pointed to weak labor conditions and tame inflation. Meanwhile, trading volume is likely to remain low as Japanese investors observe a national holiday.

USD/JPY has formed a rectangular pattern, signaling uncertainty about the pair's near-term trajectory. Furthermore, neutral oscillators warrant some caution before making directional bets. Meanwhile, recent failures below the technically important 200-day simple moving average near 148.74 support the view of an impending downside breakout. Sustained follow-through selling below 147.00 would confirm the bearish bias and expose support at the 146.30-146.20 level. The 146.00 round-figure mark would then be a strong support level. Conversely, any intraday upward movement would likely face immediate resistance near the 148.00 round-figure mark. A break above this level could trigger a fresh wave of covering gains, pushing USD/JPY towards the 200-day simple moving average resistance currently located in the 148.74 area. Sustained buying above the monthly highs in the 149.00 and 149.15 areas would negate the bearish outlook and shift the near-term bias in favor of bullish traders.

Consider shorting the US dollar at 147.60 today. Stop-loss: 147.80, target: 146.70

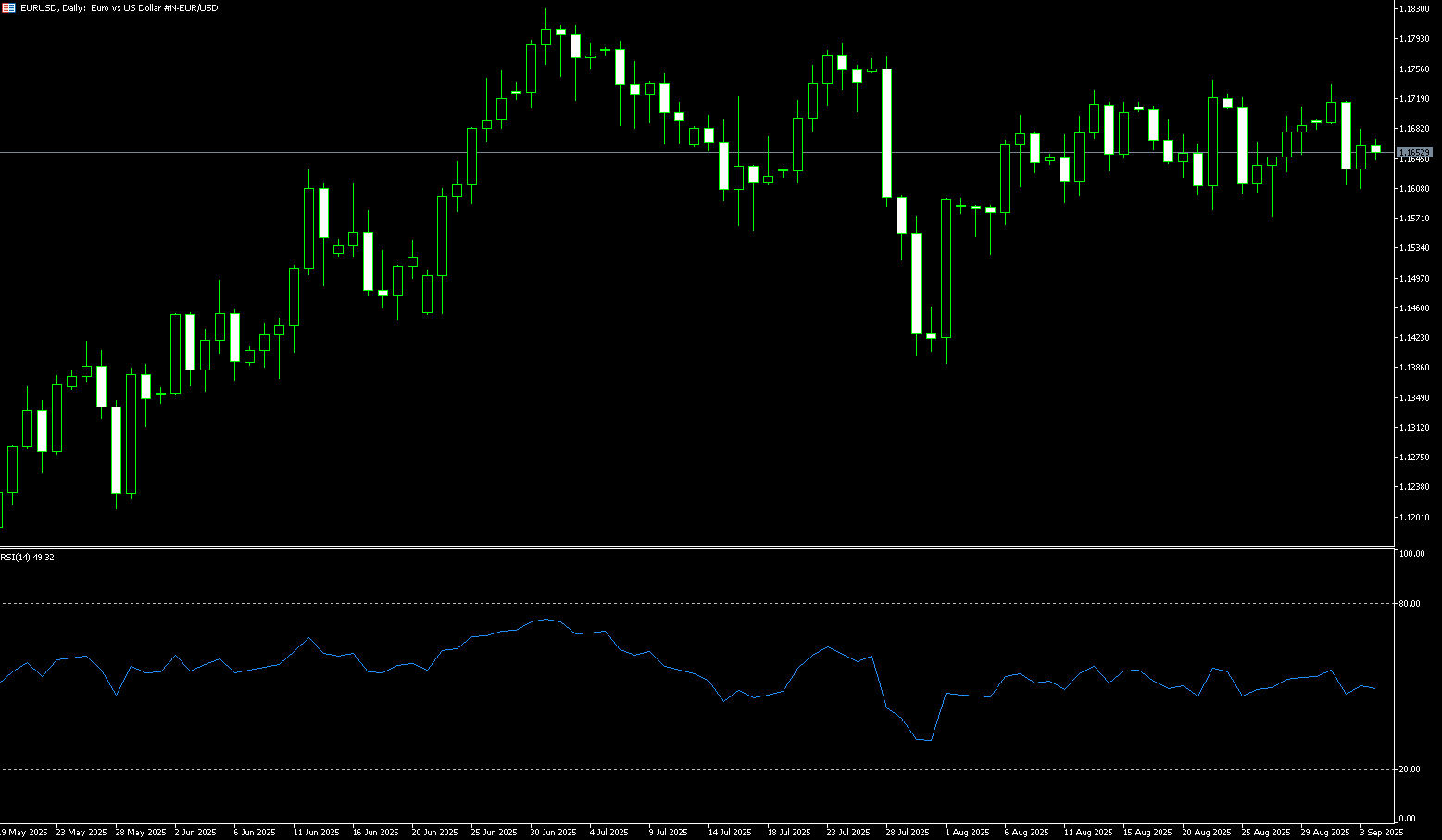

EUR/USD

EUR/USD started the new week unchanged, fluctuating around the 1.1750-1.1760 range. However, downside appears limited given the divergence in policy expectations between the ECB and the Fed, as well as key central bank event risk this week. As widely expected, the ECB held interest rates steady last Thursday and expressed optimism about economic growth and inflation. This continues to support the euro and EUR/USD. The probability of a 25 basis point rate cut by the Fed on Wednesday is over 90%. This has put dollar bulls on the defensive and provided support for the EUR/USD pair. Traders will be watching for clues on the Fed's future rate cut path, which will have a key impact on the near-term dollar price dynamics and provide some meaningful momentum for the pair. Nevertheless, the fundamental backdrop suggests that any corrective pullbacks could be seen as buying opportunities.

EUR/USD held steady above 1.1700 until the weekend, with buyers driving the exchange rate higher following Thursday's bullish "penetration" pattern. The 14-day Relative Strength Index (RSI) on the daily chart is flat, but suggests a slight advantage for buyers over sellers. A daily close above last week's high of 1.1780 would pave the way for a challenge of 1.1800 (market round-figure mark) and the year-to-date high of 1.1830, potentially leading to a test of 1.1885 (September 7, 2021 high). Otherwise, if the pair falls below the 1.1700 round-figure mark, initial support could be found at the 34-day simple moving average of 1.1654 and the 1.1600 round-figure level.

Consider a long EUR at 1.1750 today, with a stop-loss at 1.1740 and a target of 1.1795 or 1.1805.

Disclaimer: The information contained herein (1) is proprietary to BCR and/or its content providers; (2) may not be copied or distributed; (3) is not warranted to be accurate, complete or timely; and, (4) does not constitute advice or a recommendation by BCR or its content providers in respect of the investment in financial instruments. Neither BCR or its content providers are responsible for any damages or losses arising from any use of this information. Past performance is no guarantee of future results.

More Coverage

Risk Disclosure:Derivatives are traded over-the-counter on margin, which means they carry a high level of risk and there is a possibility you could lose all of your investment. These products are not suitable for all investors. Please ensure you fully understand the risks and carefully consider your financial situation and trading experience before trading. Seek independent financial advice if necessary before opening an account with BCR.