0

US Dollar Index

In the first half of the week, the US dollar generally weakened against the euro and the yen. Affected by weak ADP employment data and the government shutdown, the dollar index fell to a near one-week low of the key pivot level of 99.29. The dollar broke through a key technical level after weaker-than-expected labor market data. ADP estimates showed that US private employers laid off 11,250 people per week in October, weakening market confidence in the economy. Market concerns about a possible deterioration in the US labor market were exacerbated by this data, leading to a decline in the dollar. Meanwhile, expectations that upcoming economic data after the government shutdown ends may further confirm the economic slowdown trend. Unless bulls firmly defend 99.29 (Tuesday's low) and the psychological level of 99.00, the dollar may decline further. With weakening employment data and rising expectations of a Fed rate cut, if the upcoming government data fails to deliver a bullish surprise, the dollar may struggle to regain upward momentum.

From a technical perspective, unless bulls firmly defend the 99.29 (Tuesday's low) and the psychological level of 99.00, the US dollar may decline further. There is currently no clear support level for the downside path after breaking below these support areas. The near-term downside target is the major low of 98.57 on October 28th, just below the 50-day simple moving average at 98.50. Unless the dollar can rise above the pivot point and hold, bears may continue pushing towards the 98.00 (psychological level) below these support zones. On the other hand, a short-covering rally is not entirely impossible, but it will likely require a new catalyst—possibly from a series of official data releases following the full reopening of the government. The first resistance is at 99.87 (November 7th high), followed by 100.00 (psychological level) and the 100.13 (200-day simple moving average) area.

Today, consider shorting the US Dollar Index at 99.60, with a stop-loss at 99.70 and targets at 99.15 and 99.20.

WTI Crude Oil

On Wednesday in European trading, US crude oil traded around $58.50 per barrel, down more than 4%. Oil prices rose on Tuesday, boosted by new US sanctions against Russia and the prospect of an end to the US government shutdown, but concerns about oversupply limited gains. US sanctions against Russia's Lukoil have impacted the company's operations in Europe, potentially affecting winter energy supplies in several European countries. Asen Asenov, head of Bulgaria's National Reserves and War Stockpiles Agency, revealed that Bulgaria only has enough gasoline on hand for about a month. The market is currently navigating a tug-of-war between geopolitical risks and fundamental supply and demand dynamics, with investors continuing to assess the consequences of sanctions and their potential impact on the global crude oil and refined product markets.

The daily chart shows that WTI crude oil prices have been trading above the Bollinger Band middle line (latest price $59.60) for the past three weeks. Furthermore, the closing price has tested the Bollinger Band middle line for the past three weeks without breaking it, indicating strong support from the bulls. Attempts to break through this area have resulted in breaches of the psychological level of $60.00 and a brief dip above $61.00. Currently, the 14-day Relative Strength Index (RSI) has fallen to 41.00, indicating moderate weakness. If oil prices continue to rise above $60.00 (the psychological level), it will open up upward potential to $62.38 (the October 24 high). A break above this level would target the 55-day simple moving average at $63.07. On the other hand, if oil prices break below the psychological level of $58.00, they will continue to test the $57.31 (October 21 low) and the $57.00 (psychological level) area.

Today, consider going long on crude oil at $58.26, with a stop loss at $58.10 and targets at $59.80 and $60.00.

Spot Gold

On Wednesday morning in European trading, spot gold traded around $4,195 per ounce, up more than 1.5%, reaching its highest level in nearly three weeks. Market expectations that the US government shutdown is about to end, and the subsequent resumption of economic data could create conditions for a Federal Reserve rate cut next month, have kept the dollar index, which tracks the dollar against six major currencies, trading around 99.29, near a two-week low, marking its fifth consecutive day of decline and continuing to support gold prices. Traders anticipate weak economic data that would prompt the Fed to cut rates in December, thus encouraging bullish sentiment in the gold and silver markets. Against this backdrop, coupled with ongoing geopolitical risks, the short-term outlook for gold prices remains constructive, with buyers likely to remain active during pullbacks. Gold demand this year and next is projected to reach its strongest level since 2011, providing fundamental support for the medium- to long-term trend.

At the start of the week, spot gold finally broke out of its two-week consolidation range between $3,900 and $4,050, and broke above the near three-week high of $4,211. This confirms the short-term bullish breakout pattern. Currently, gold prices face immediate resistance around $4,200-$4,250. A decisive break above this level could strengthen bullish momentum, moving towards the $4,300 mark and potentially paving the way for a retest of the all-time high of around $4,381. On the downside, the 14-day Relative Strength Index (RSI) is currently near 63, suggesting that bulls should remain cautious. A brief pullback or consolidation is possible before gold attempts its next upward move. Therefore, the $4,100 level and $4,082 (the 20-day simple moving average) are the first support levels, followed by stronger support around $4,050, which is the upper edge of the previous consolidation range.

Consider going long on gold today at $4,190, with a stop loss at $4,185 and targets at $4,230 and $4,240.

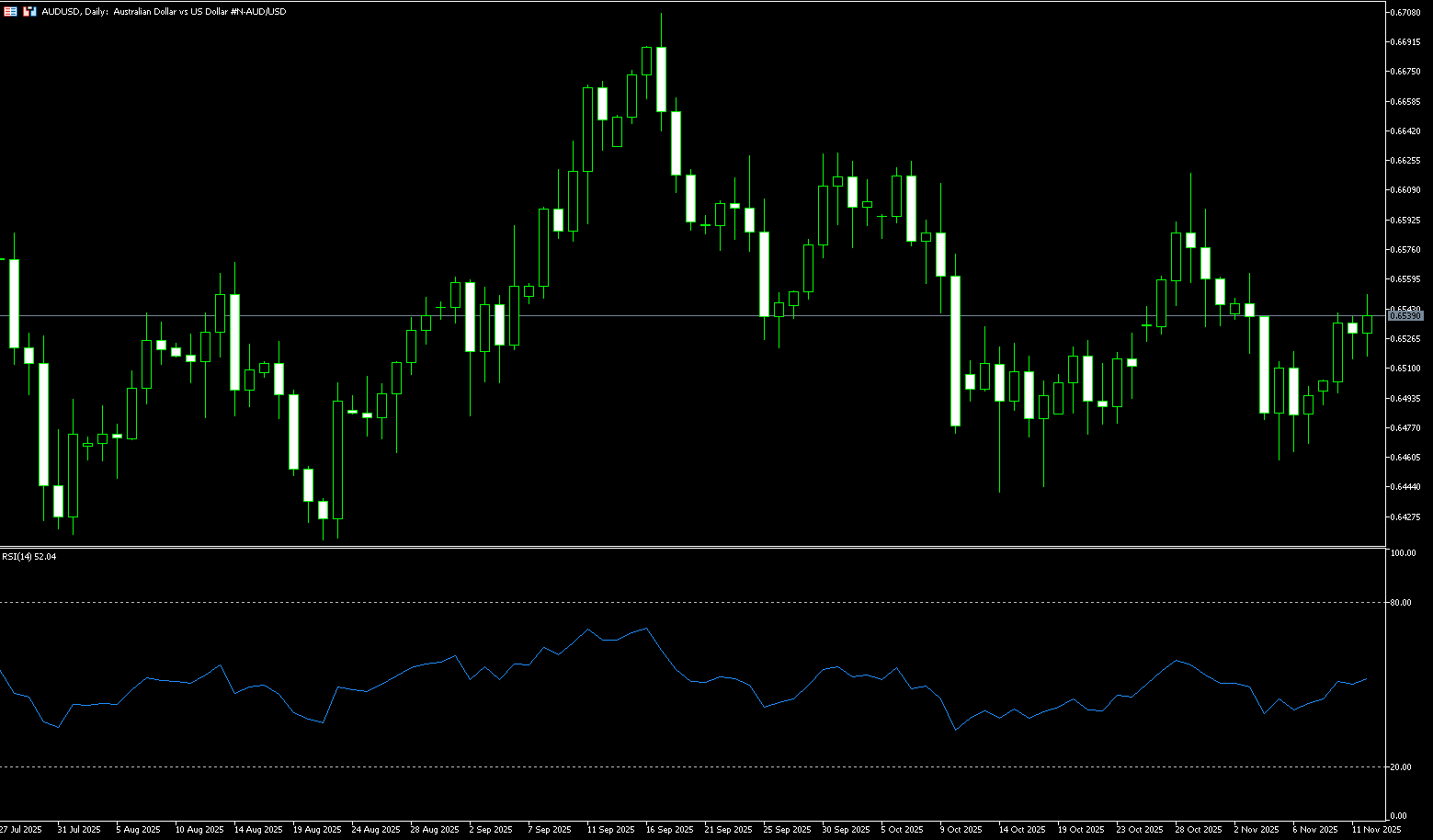

AUD/USD

The Australian dollar is trading around US$0.6540, near a one-week high, after Reserve Bank of Australia (RBA) Deputy Governor Andrew Hauser noted unusual challenges facing monetary policy and stressed the need to maintain a tight monetary policy to curb inflation. Hauser added that demand “slightly” exceeded potential levels when GDP growth accelerated last year, marking the most contracting recovery since the early 1980s, leaving little room for expansion without reigniting inflation. Earlier this month, the RBA kept its policy rate unchanged at 3.6%, facing continued pressure on underlying prices. The market widely expects another rate cut before May next year. On the data front, Australia's Westpac Consumer Confidence Index surged 12.8% in November to 103.8, a seven-year high and the first time it has exceeded 100 since February 2022. Furthermore, the Australian dollar was supported by improved risk sentiment, fueled by hopes that the record-long US government shutdown might be ending.

On Wednesday, the Australian dollar traded around 0.6540 against the US dollar. Technical analysis on the daily chart shows the pair remaining in a narrow range above 0.6500. However, the pair is near the 9-day simple moving average at 0.6518, indicating no clear short-term momentum bias. A successful break above the 40-day simple moving average at 0.6540 would target 0.6597 (the October 30 high) and the 0.6600 area. A break above this level would improve medium-term price momentum and support the pair exploring the October 1 high of 0.6630. Further gains would support the pair's target of 0.6707, the 13-month high reached on September 17. Conversely, a break below the psychological level of 0.6500 could weaken short-term momentum and push the pair closer to the 200-day simple moving average near 0.6453 and the five-month low of 0.6414 reached on August 21.

Consider going long on the Australian dollar today at 0.6528, with a stop loss at 0.6515 and targets at 0.6570 and 0.6580.

GBP/USD

The pound fell to around $1.3120 against the dollar after weaker-than-expected labor market data reinforced market expectations of a Bank of England rate cut next month. Regular wage growth slowed to 4.6% in the third quarter, the weakest since February-April 2022, while total wages, including bonuses, rose 4.8%, slightly below the forecast of 4.9%. Meanwhile, the unemployment rate climbed to 5.0%, the highest level in four years, exceeding the expected 4.9%, due to an increase in the number of unemployed and the first decline in employment since early 2024. The Bank of England kept interest rates unchanged last week but hinted that a rate cut in December is still possible as policymakers assess the extent to which domestic inflationary pressures may persist. Investors are now awaiting Thursday's third-quarter GDP data for more insights ahead of the autumn 2025 budget.

From a technical perspective, GBP/USD found some support last week in the 1.3010 and 1.3000 (psychological level) area. A decisive break below this support area should pave the way for deeper losses, as the 14-day Relative Strength Index (RSI) on the daily chart shows weakness (currently around 39). GBP/USD may weaken further. A break below 1.3100 would test support at 1.3046 (the November 6 low) and head towards the 1.3000-1.3010 area. On the other hand, the 1.3200 level should act as key resistance. Further buying could trigger short-term profit-taking, pushing GBP/USD to the 1.3275 (200-day simple moving average) level. A subsequent rise could further target the 1.3300 psychological level. A strong break above the latter would negate the recent negative outlook and turn bullish for traders.

Consider going long GBP at 1.3112 today, with a stop-loss at 1.3100 and targets at 1.3160 and 1.3170.

USD/JPY

The yen continued to struggle to attract any meaningful buying during Wednesday's Asian session, hovering near its lowest level since February 13, after hitting a low with its US counterpart the previous day. The Bank of Japan remains cautious about further interest rate hikes due to Prime Minister Sanae Takaichi's stimulus policy stance. Furthermore, optimism regarding a potential agreement to end the US government shutdown is a key factor weakening the safe-haven yen. Meanwhile, the summary of opinions from the Bank of Japan policymakers at their October meeting, released Monday, indicated a possible rate hike in December. Coupled with market speculation that Japanese authorities might intervene to curb further depreciation of the yen, this could prevent yen shorts from making aggressive bets. Additionally, the dollar has generally weakened due to bets on further rate cuts by the Federal Reserve and concerns about the potential economic impact of the US government shutdown, which could limit the upside for USD/JPY.

From a technical perspective, USD/JPY bulls need to wait for sustained strength above the key resistance level of 154.90 (Wednesday's high) before making new bets. Given that the 14-day moving average on the daily chart remains in positive territory and is still far from overbought, the first resistance level is likely to be the psychological level of 155.00. Momentum could extend further to 155.88 (February 3 high) and the psychological level of 156.00. On the other hand, any correction below 154.00 could see a drop to 153.55 (14-day simple moving average). This should help limit downside for USD/JPY near the 153.00 level. A decisive break below this level could shift the short-term bias towards bearish traders.

Consider shorting USD at 155.05 today. Stop loss: 155.30. Target: 154.10, 154.00

EUR/USD

The euro continued its recent rebound against the dollar on Wednesday, gradually climbing after consolidating around 1.1580 and successfully recovering previous losses. It is currently trading around 1.1585. Despite weak German economic data, the market largely ignored it, and the euro/dollar pair steadily rose, supported by a moderate recovery in risk appetite following the agreement on a solution to the US government shutdown. News that the US government shutdown is expected to end pushed the dollar slightly higher against a basket of major currencies, but it also boosted market sentiment, providing support for risk-related assets such as the euro, allowing the euro to maintain a sideways consolidation before gradually rising against the dollar. The next key catalyst for the euro/dollar exchange rate will be the upcoming statement from European Central Bank President Christine Lagarde. Her speech will provide more clues about the policy direction of future meetings, with most traders expecting the ECB to keep interest rates unchanged. Although current market risk appetite and expectations of rate cuts support the euro, potential risks still need to be monitored.

The daily chart shows that the euro/dollar's drop below the key 1.1500 level to a near four-month low of 1.1468 last week was a typical bear trap—a false breakout before a bullish reversal or an irrational selling point driven by panic. The exchange rate subsequently rebounded quickly, and the current resistance level is around the psychological level of 1.1700. Currently, the exchange rate is fluctuating between 1.1700 and 1.1468. The 14-day Relative Strength Index (RSI) technical indicator shows that buyers are accumulating momentum, but the index remains slightly below the neutral level of 50, indicating that bears are still in control. A break below 1.1500 would expose the cycle low of 1.1468 from October 5th, reinforcing the broader downtrend. On the other hand, a sustained break above the psychological level of 1.1600 would pave the way for a challenge of 1.1650 (the high of October 17th) and the 1.1700 level.

Today, consider going long on the Euro at 1.1575, with a stop loss at 1.1563 and targets at 1.1640 and 1.1630.

Disclaimer: The information contained herein (1) is proprietary to BCR and/or its content providers; (2) may not be copied or distributed; (3) is not warranted to be accurate, complete or timely; and, (4) does not constitute advice or a recommendation by BCR or its content providers in respect of the investment in financial instruments. Neither BCR or its content providers are responsible for any damages or losses arising from any use of this information. Past performance is no guarantee of future results.

More Coverage

Risk Disclosure:Derivatives are traded over-the-counter on margin, which means they carry a high level of risk and there is a possibility you could lose all of your investment. These products are not suitable for all investors. Please ensure you fully understand the risks and carefully consider your financial situation and trading experience before trading. Seek independent financial advice if necessary before opening an account with BCR.

BCR Co Pty Ltd (Company No. 1975046) is a company incorporated under the laws of the British Virgin Islands, with its registered office at Trident Chambers, Wickham’s Cay 1, Road Town, Tortola, British Virgin Islands, and is licensed and regulated by the British Virgin Islands Financial Services Commission under License No. SIBA/L/19/1122.

Open Bridge Limited (Company No. 16701394) is a company incorporated under the Companies Act 2006 and registered in England and Wales, with its registered address at Kemp House, 160 City Road, London, City Road, London, England, EC1V 2NX. This entity acts solely as a payment processor and does not provide any trading or investment services.