0

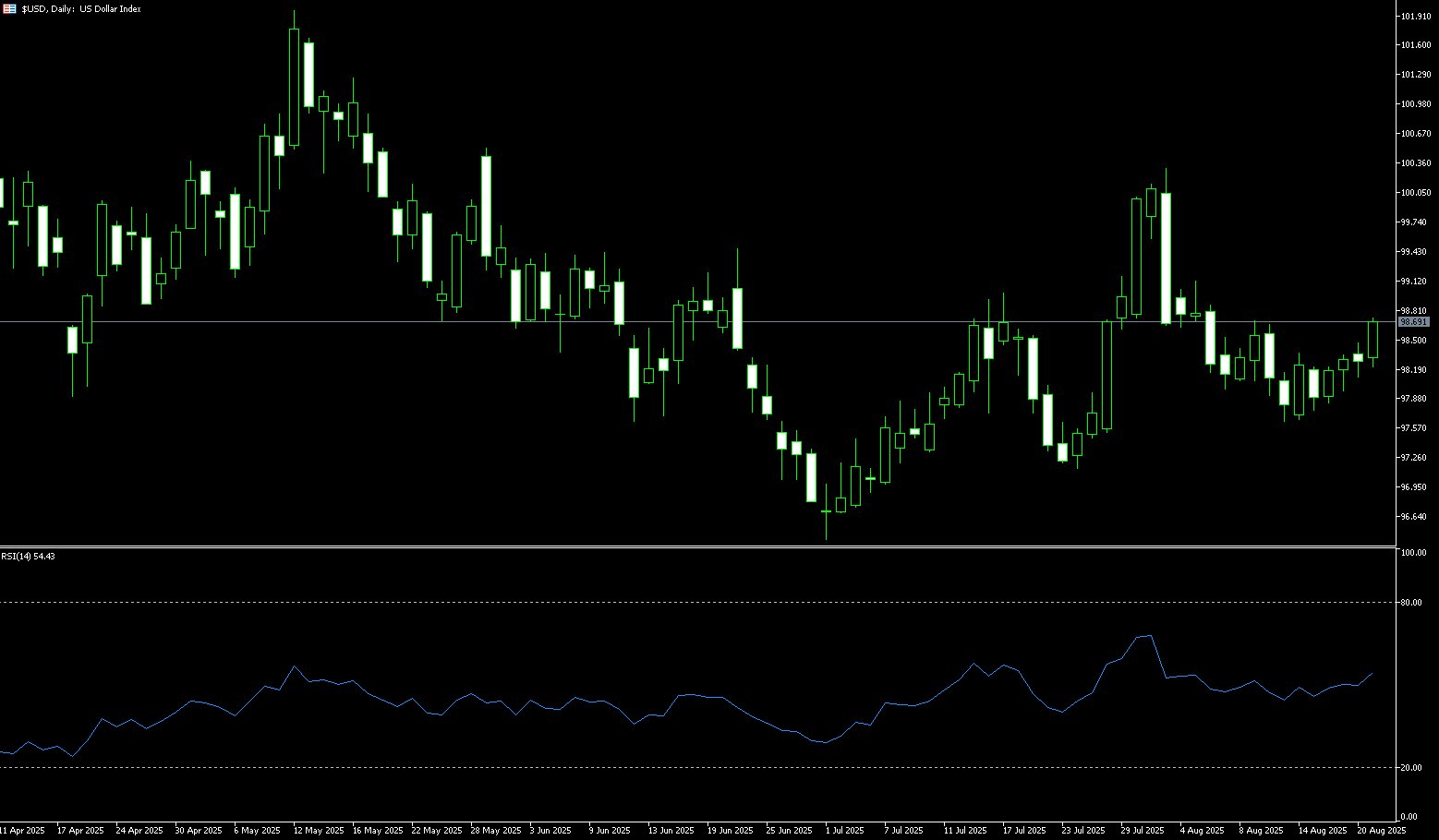

US Dollar Index

The US dollar index consolidated around 98.60 on Thursday, stabilizing after recent gains. Investors awaited guidance from the Federal Reserve's annual Jackson Hole symposium for a glimpse into the path of interest rates. Markets are focused on Fed Chairman Jerome Powell's speech for signals on whether policymakers might buck recent expectations for easing. Futures markets currently price in an 82% probability of a quarter-point rate cut in September, down from 94% a week ago. Minutes from the Fed's July meeting showed officials remained more focused on inflation than labor market risks, with tariffs further dividing the committee. In Washington, President Donald Trump demanded the resignation of Federal Reserve Governor Lisa Cook over allegations of mortgage fraud and reiterated his stance on rate cuts. Powell's term expires in May, and Trump is weighing potential successors, while Treasury Secretary Scott Bessant has publicly supported a larger, half-percentage-point rate cut in September.

Technical analysis on the daily chart shows the US dollar index trading slightly above a descending channel pattern, suggesting a possible bullish bias. The 14-day relative strength index (RSI) is above 50, indicating neutral market sentiment. Further movement will provide clarity on the directional trend. However, short-term price momentum has strengthened as the US dollar index has broken through the psychological market level of 98.00. On the upside, the US dollar index is testing its 100-day moving average at 99.01, followed by the key round number at 99.00. A successful break above the latter could improve medium-term price momentum and allow the US dollar index to test the three-week high of 99.07, reached on August 5. A break below the 98.00 level would exert downward pressure on the US dollar index, pushing it back towards the "double bottom" formation of 97.63. Further declines would push the US dollar index towards the six-week low of 97.11, reached on July 24.

Consider shorting the US Dollar Index at 98.80 today, with a stop-loss at 98.90 and targets at 98.30 and 98.20.

WTI Spot Crude Oil

US crude oil was trading around $63.30 per barrel. Oil prices rose on Wednesday, as US crude oil inventories fell more than expected last week. Investors awaited further progress in talks regarding the Ukraine conflict, where Russian crude oil remains subject to sanctions. The US Energy Information Administration (EIA) reported a 6 million barrel drop in US crude oil inventories. The market saw a rebound in exports, which, combined with strong refining demand, made the report positive. Oil prices rose as much as 1.7% midweek, driven primarily by buying driven by concerns about potential global supply disruptions. Currently, a slight rebound in buying pressure has led to increased market volatility, with investors focusing on the situation in Ukraine. Further escalation of tensions there could trigger new sanctions against Russia, disrupting global crude oil transportation links. In the short term, if supply-side risk expectations continue to build, oil prices are expected to regain bullish momentum.

Since breaking through the upward trend line, market expectations of a weak and volatile oil price trend turning downward have not materialized. Oil prices have failed to reach a lower low, suggesting a sideways trading pattern is developing. The 14-day Relative Strength Index (RSI) maintains an upward slope and is gradually approaching the neutral 50 level, indicating a near-term equilibrium between bullish and bearish forces and a neutral market sentiment. The MACD further confirms the lack of a clear short-term direction. Key resistance lies at the 100-day moving average at $63.89 and the 65-day moving average at $65.39. A sustained breakout would confirm the bullish trend and open up upside potential to the $66.00 round-figure mark. A sustained breakout and close below the $62.00 support level could trigger further declines to the $61.35 (August 13 low) and the $61.00 round-figure mark, with the next downside target being the psychological $60 mark.

Consider going long on crude oil at 63.20 today. Stop-loss: 63.00. Target: 64.50, 64.80.

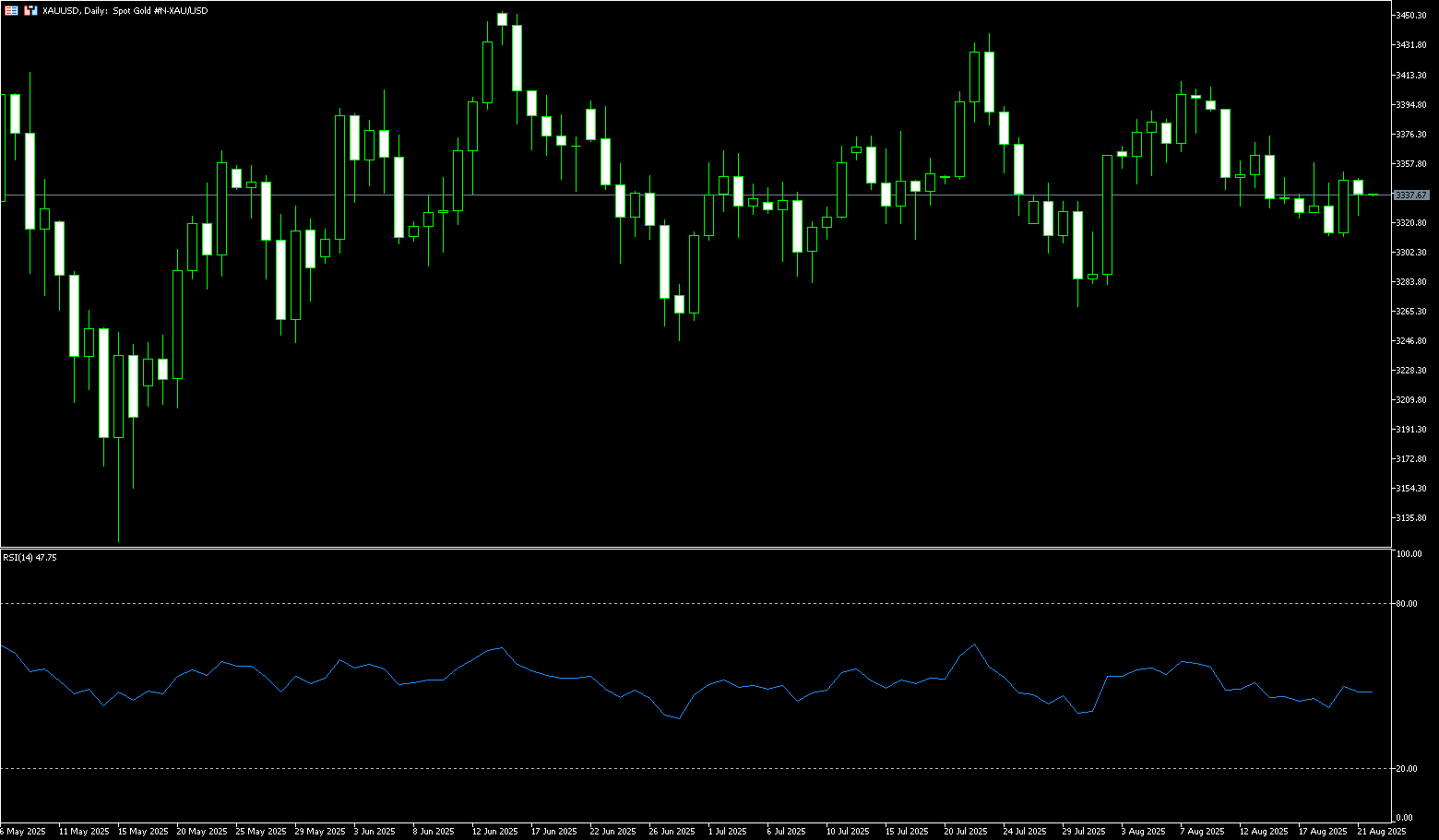

Spot Gold

On August 21, Beijing time, spot gold traded around $3,340/oz. Gold prices rose on Wednesday, as the US dollar weakened and market participants prepared for the upcoming Jackson Hole symposium. Meanwhile, the Federal Reserve minutes showed that only two policymakers appeared to support a rate cut at the July meeting. Traders have viewed the pre-July employment data as outdated information, focusing instead on more forward-looking policy signals. Against this backdrop, gold's appeal as a non-US dollar asset has significantly increased, attracting significant capital inflows and driving prices higher. If Powell refutes rate cut expectations, this could be seen as a move by the Fed to depoliticize, further boosting gold's safe-haven demand. Regardless of the outcome, the symposium will be a catalyst for short-term fluctuations in gold prices, and investors should closely monitor Powell's words to identify potential buying opportunities.

In summary, the current rebound in the gold market is not only a direct result of a weakening dollar, but also a product of a combination of Fed policy expectations, political intervention, and economic uncertainty. In the short term, gold prices may fluctuate following Powell's speech, but the upward trend is expected to continue in the medium to long term. The 14-day Relative Strength Index (RSI) on the daily chart is fluctuating near the 50.00 neutral line, indicating a tussle between bulls and bears at the current price level. It's important to note that gold prices have yet to stabilize above their 55-day moving average of $3,348.20. The $3,350.00 mark is also a key psychological barrier. Before stabilizing between $3,348.20 and $3,350.00, caution is warranted regarding the possibility of gold prices retesting their 100-day moving average, currently supported by support near $3,313.80, as well as the psychologically important $3,300 mark.

Consider going long on gold at 3,334 today, with a stop loss at 3,330 and targets at 3,355 and 3,360.

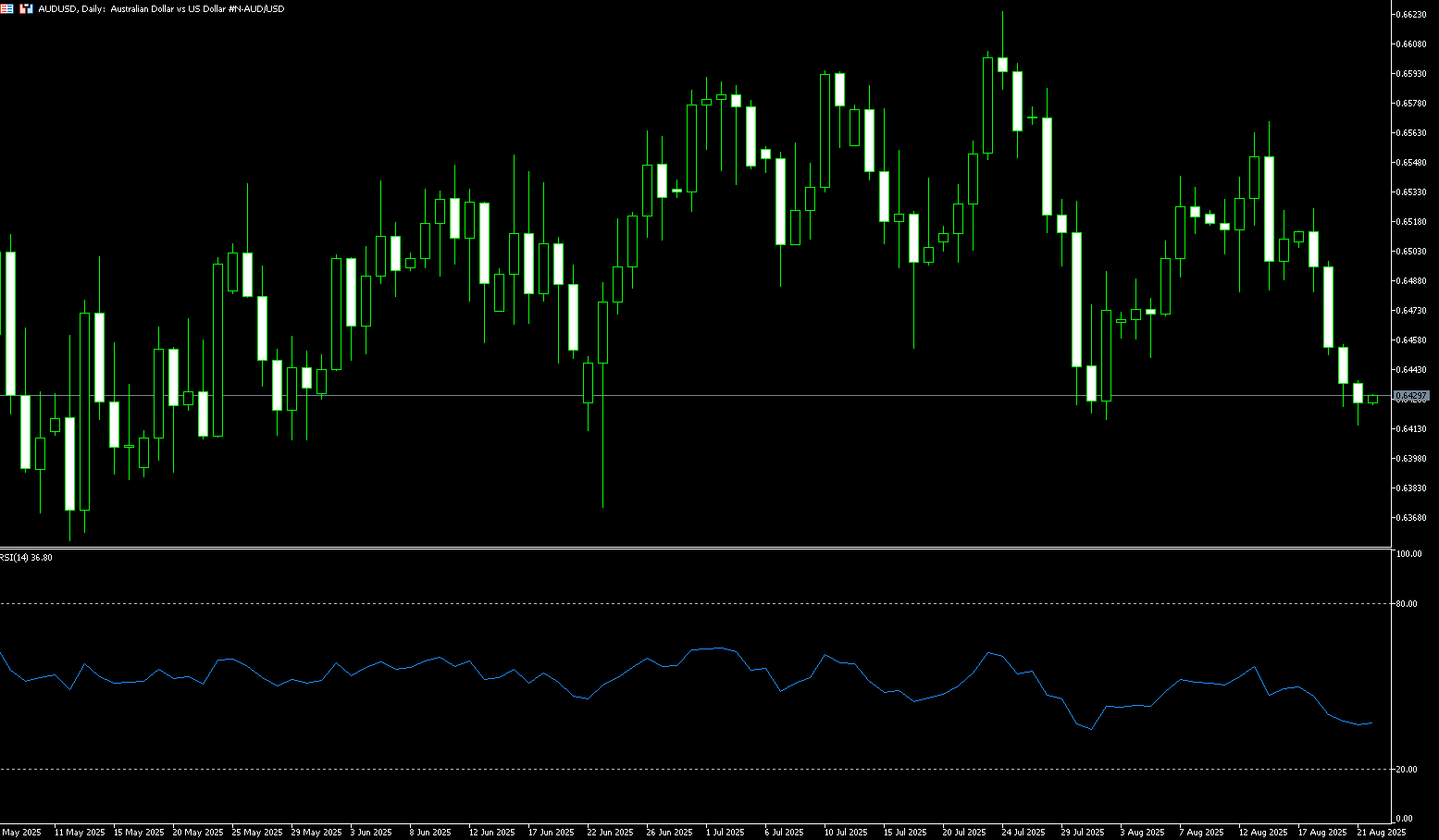

AUD/USD

The Australian dollar depreciated above $0.6420 on Thursday, marking its fourth consecutive day of decline and remaining at a three-week low, coinciding with the release of the latest economic data. Australia's private sector grew at its fastest pace since April 2022, with the composite Purchasing Managers' Index rising to 54.9 in August, driven by strong expansion in both the services sector (55.1, compared to 54.1 in July) and the manufacturing sector (52.9, compared to 51.3 in July), with significant growth in new orders and a broader customer base. Meanwhile, consumer inflation expectations fell for the second consecutive month, from 4.7% in July to 3.9% in August 2025—the lowest level since March. In the first quarter, annual inflation remained steady at 2.4%—the lowest level in four years and unchanged for the third consecutive quarter—while the Reserve Bank of Australia's preferred measure of core inflation, the trimmed mean CPI, fell to 2.9%, the lowest level since late 2021, though still slightly above the midpoint of the RBA's 2-3% target range.

AUD/USD traded around 0.6420 on Thursday. Technical analysis on the daily chart suggests that short-term momentum is waning, as the pair remains below its 20-day moving average of 0.6490 and the psychologically important 0.6500 area. Furthermore, the 14-day relative strength index (RSI) remains below 37, indicating a bearish market bias. On the downside, AUD/USD could target 0.6400, followed by the three-month low of 0.6372 reached on June 23, and 0.6350. Key resistance lies at the 100-day moving average at 0.6454, followed by the 0.6500 round-figure mark. A breakout above this critical resistance range could improve short- and medium-term price momentum and propel the pair towards its August 14th monthly high of 0.6568.

Consider a long position on the Australian dollar at 0.6410 today, with a stop-loss at 0.6400 and targets at 0.6450 or 0.6460.

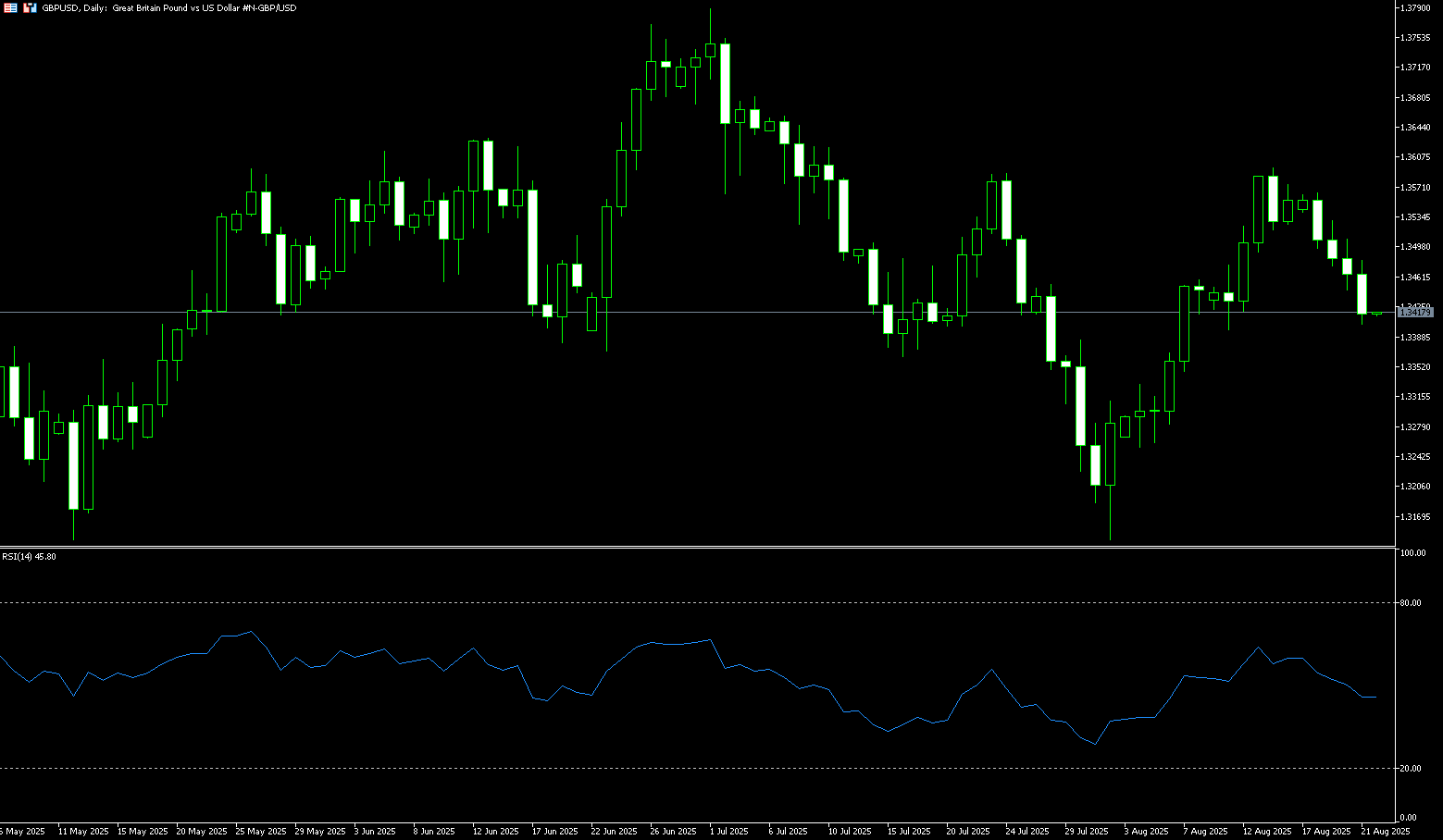

GBP/USD

GBP/USD slipped to approximately 1.3420 during Thursday's trading session, pressured by a modest rebound in the US dollar. All eyes will be on the Federal Reserve's annual Jackson Hole symposium on Friday. Due to a jump in US wholesale prices last month, the US dollar strengthened against the British pound, reducing the likelihood of a rate cut at the Fed's September meeting. According to the CME FedWatch tool, the market is pricing in a near 80% probability of a rate cut at the Fed's next policy meeting, with a total of 52 basis points expected for the year. Investors are bracing for potential market volatility from Friday's Jackson Hole symposium. If Federal Reserve Chairman Jerome Powell delivers hawkish comments or adopts a wait-and-see approach, this could boost the US dollar and create resistance for major currency pairs. Investors anticipate a longer wait before the next Bank of England rate cut, which could provide some support for the British pound.

Following the release of the UK inflation report, the downtrend resumed after reaching 1.3500. However, threats to the Fed's independence triggered a reaction from traders, who booked profits after GBP/USD broke through the 50-day simple moving average at 1.3495, leading to a subsequent pullback to the 1.3400 level. While the 14-day relative strength index (RSI) remains bullish, its slope appears close to penetrating its neutral line. Therefore, further downside is possible in the short term. If GBP/USD continues to break below 1.3400, sellers could push the exchange rate towards 1.3346, seen on August 7, and then towards 1.3300. On the other hand, if the pair climbs back above 1.3500, buyers could test the August 18 high of 1.3565, followed by the psychological 1.3600 level.

Consider a long position on GBP at 1.3400 today, with a stop-loss at 1.3390 and targets at 1.3460 and 1.3470.

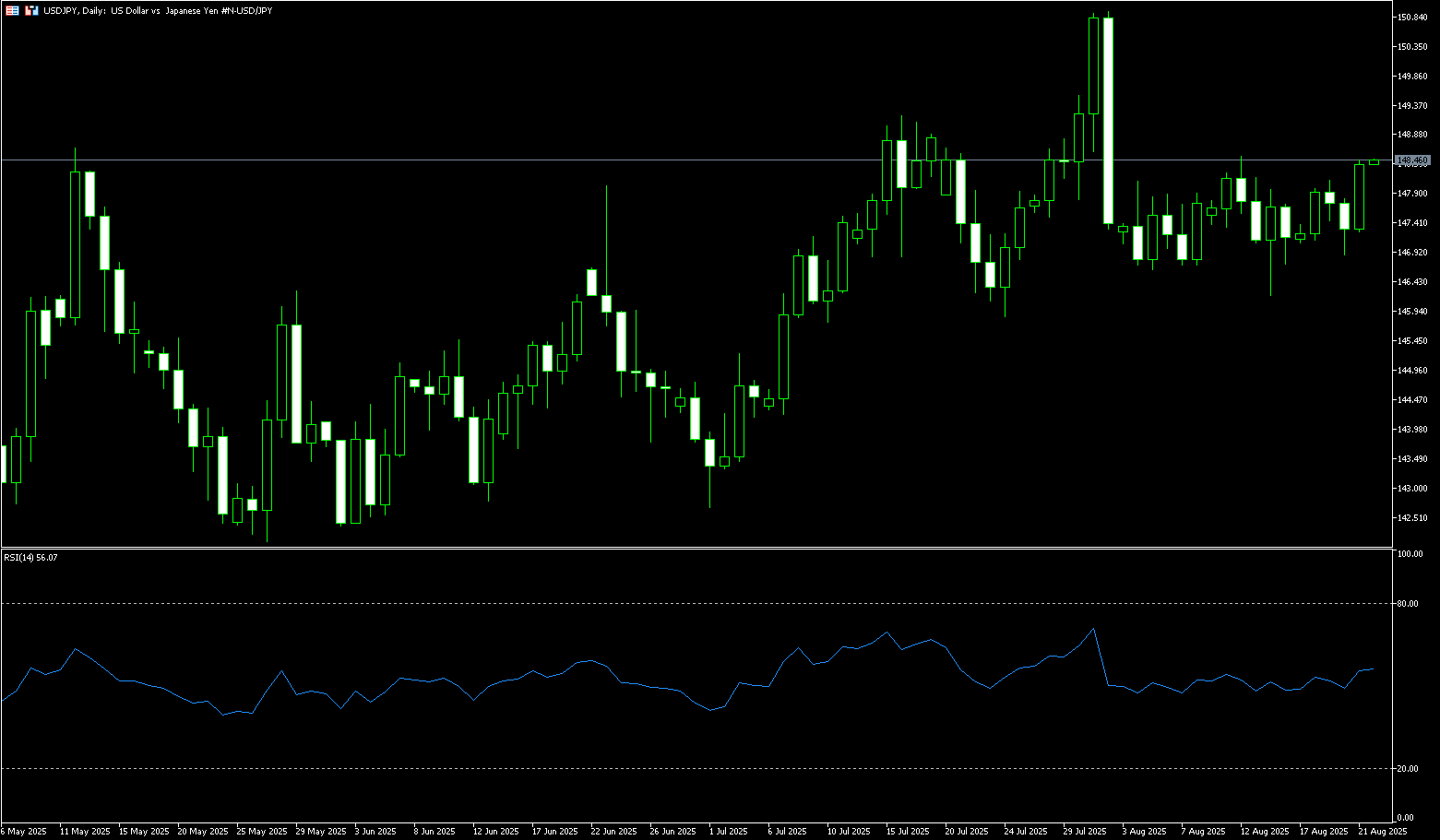

USD/JPY

The yen weakened to around 148.30 per dollar on Thursday, ending a two-day rally as uncertainty over the Bank of Japan's policy outlook persisted. With inflation continuing to rise and wages lagging behind price growth, the Bank of Japan is under pressure to raise interest rates. At its July meeting, the central bank raised its inflation forecast and left the door open to a possible rate hike by the end of the year. Despite this, Governor Kazuo Ueda remained cautious, emphasizing that "underlying inflation" has not yet firmly reached the 2% target. On the data front, Japan's manufacturing sector edged closer to stabilization in August, while growth in the services sector slowed. Externally, investors awaited signals from the Federal Reserve's Jackson Hole symposium for insights into the global interest rate outlook.

USD/JPY has broken out of consolidation between its 20-day and 50-day simple moving averages, at 147.94 and 146.75, respectively. Momentum suggests that both buyers and sellers are refraining from actively initiating new positions, awaiting the outcome of Federal Reserve Chairman Jerome Powell's speech at Jackson Hole. If USD/JPY manages to hold above both the 20-day and 50-day SMAs, it could test the August 12 high of 148.51, followed by the 200-day SMA at 149.14. On the other hand, if the pair falls below both the 20-day and 50-day SMAs, initial support could be found at Thursday's low of 147.26. Once above these levels, the next targets are the 146.00 round number and the 100-day SMA at 145.46.

Consider shorting the US dollar at 148.55 today. Stop loss: 148.75, target: 147.50, 147.40.

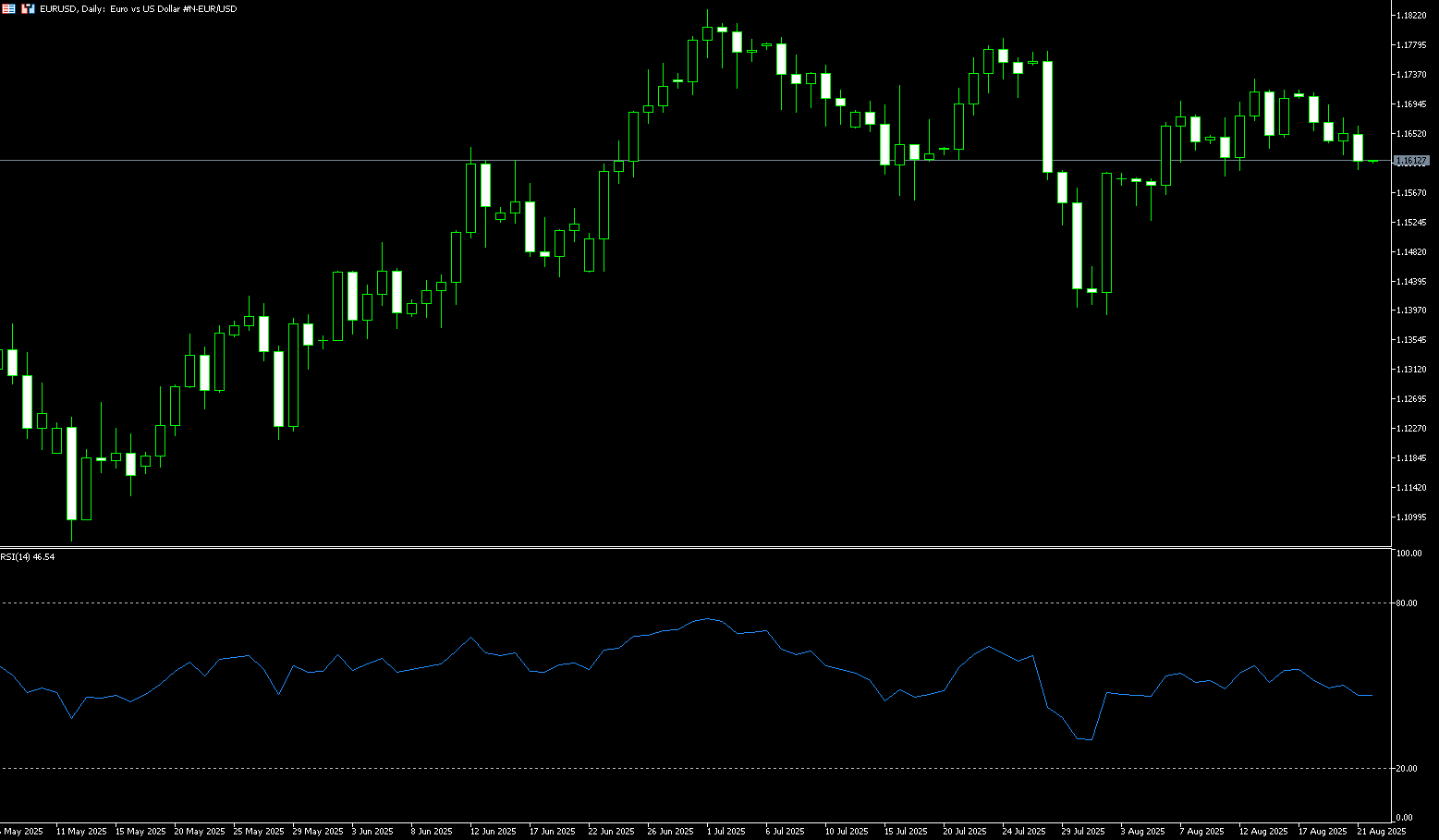

EUR/USD

The euro remained steady above $1.1600 as the market awaited this week's central bank governors' symposium and digested discussions in Washington about ending Russia's war in Ukraine. NATO Secretary-General Mark Rutte called Trump's meeting with Zelensky and European leaders "very successful," while Trump said he had contacted Putin to arrange a meeting with Zelensky, followed by a trilateral summit. Regarding monetary policy, ECB interest rate expectations remained stable, with markets anticipating no change in September. In the US, traders see an 85% probability of a 25 basis point rate cut by the Federal Reserve at its September 16-17 meeting. Investors are closely watching Fed Chairman Jerome Powell's speech at Jackson Hole for guidance on future US monetary policy.

EUR/USD's neutral bias remains intact, as evidenced by two technical indicators: the lack of clear direction in the exchange rate, with the short-term daily simple moving average remaining nearly flat; and the 14-day relative strength index (RSI) hovering near its neutral line. If EUR/USD breaks above the August 19 high of 1.1692, a move toward 1.1700 becomes possible. Once above, further gains await, as the July 24 high of 1.1788 will serve as key resistance, followed by the 1.1800 level. On the other hand, a break below the psychologically important 1.1600 level could trigger a move toward the 65-day simple moving average at 1.1589, with the 75-day simple moving average at 1.1534 becoming the next downside target.

Consider a long position on EUR at 1.1600 today, with a stop-loss at 1.1590 and a target at 1.1655 or 1.1660.

Disclaimer: The information contained herein (1) is proprietary to BCR and/or its content providers; (2) may not be copied or distributed; (3) is not warranted to be accurate, complete or timely; and, (4) does not constitute advice or a recommendation by BCR or its content providers in respect of the investment in financial instruments. Neither BCR or its content providers are responsible for any damages or losses arising from any use of this information. Past performance is no guarantee of future results.

More Coverage

Risk Disclosure:Derivatives are traded over-the-counter on margin, which means they carry a high level of risk and there is a possibility you could lose all of your investment. These products are not suitable for all investors. Please ensure you fully understand the risks and carefully consider your financial situation and trading experience before trading. Seek independent financial advice if necessary before opening an account with BCR.