0

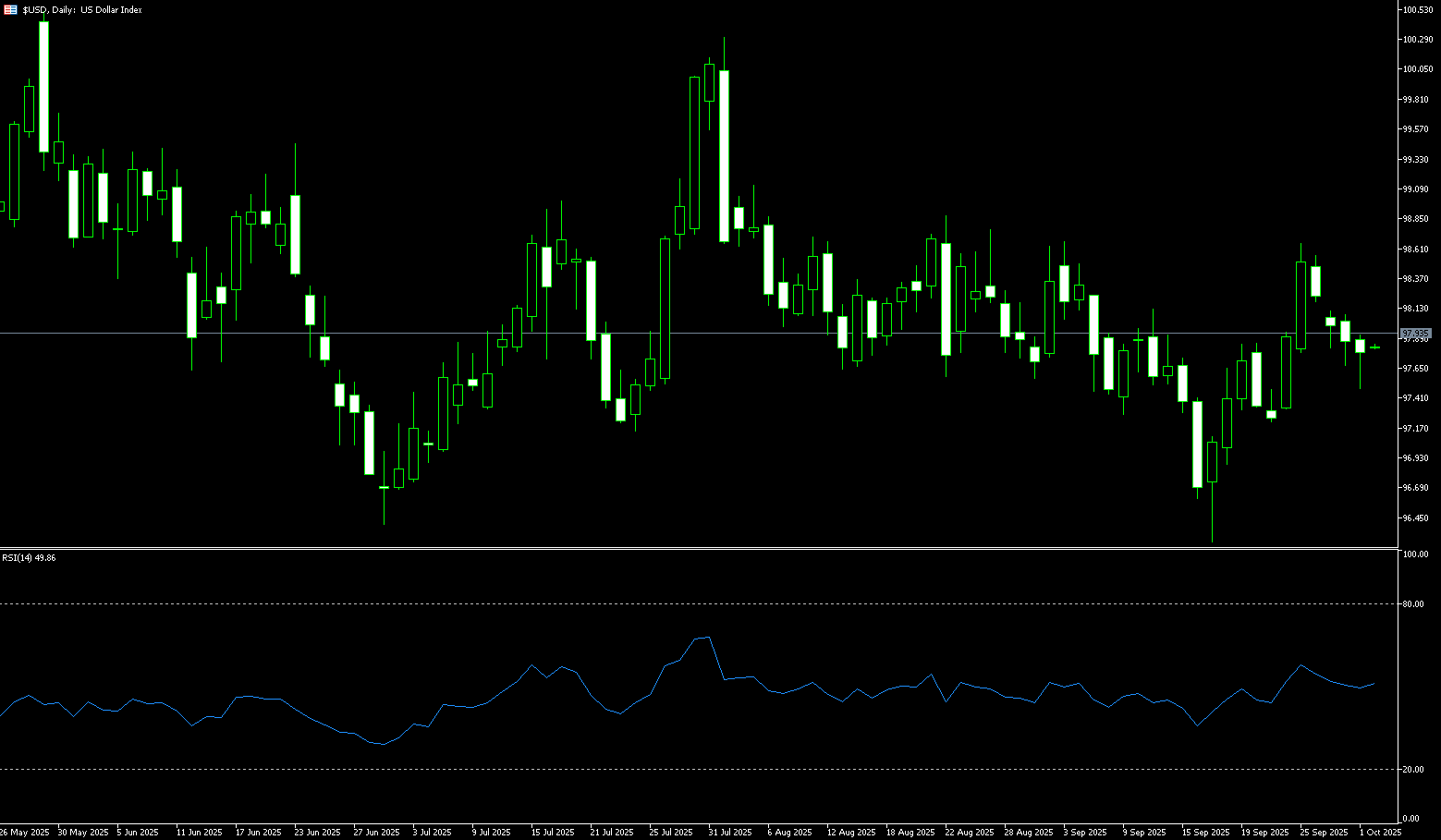

US Dollar Index

The US dollar index struggled to capitalize on its rebound from a one-week low, trading in a narrow range during Thursday's Asian session. However, it edged up to around 97.86, snapping a four-day decline as weak US jobs data and the government shutdown heightened expectations of a Federal Reserve rate cut. The index appears vulnerable to dovish Fed expectations. Traders have begun pricing in the possibility of two more rate cuts from the Fed in October and December, a bet confirmed by Wednesday's disappointing US private sector payroll data. Separately, the Institute for Supply Management's Purchasing Managers' Index (PMI) slightly exceeded consensus expectations, improving to 49.1 from 48.7 in September. However, this still indicates a seventh consecutive month of contraction in manufacturing business activity, failing to attract any follow-through buying for the dollar. Concerns that a prolonged US government shutdown could negatively impact economic performance are acting as headwinds for the dollar.

Currently, the confluence of political instability, a weak labor market, and weakening technicals has shifted market sentiment towards the dollar in an overall bearish direction. From a technical perspective, the US dollar index has fallen below its 50-day simple moving average (SMA) at 98.06 and is currently heading towards the 50% retracement of its short-term range (96.21 to 98.60) at 97.41. This level is expected to provide initial support, potentially triggering a short-covering rally. However, a break below 97.21 (the low of September 23) would signal a short-term trend reversal and could lead to further declines to 97.00 (the round number mark) and a quick retest of 96.84 (the low of September 18). Above this level, focus is on the psychological support levels of 98.00 and the 50-day SMA at 98.06.

Consider shorting the US Dollar Index at 97.96 today, with a stop-loss at 98.05 and targets at 97.50 and 97.40.

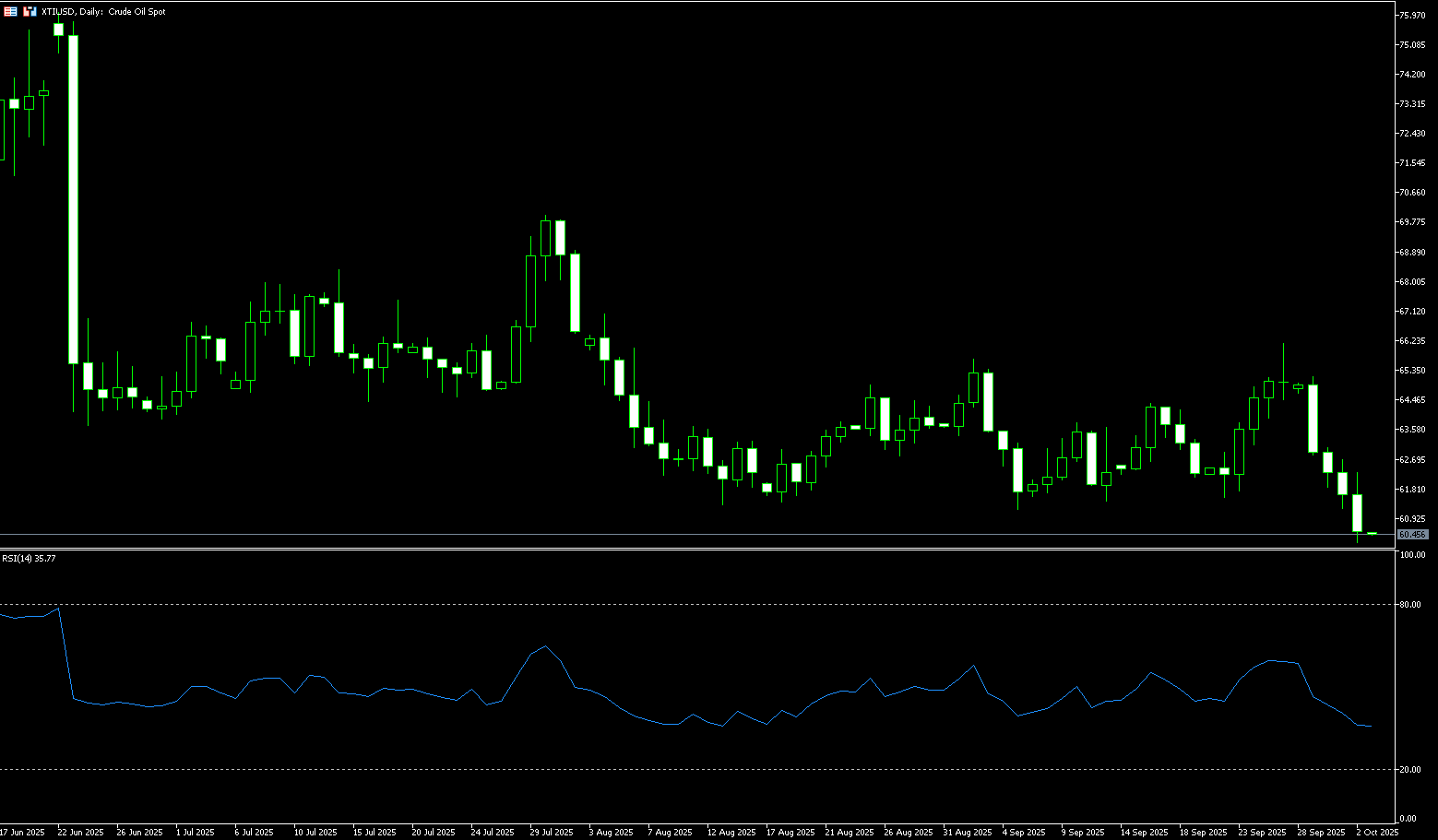

WTI Spot Crude Oil

WTI crude oil futures fell over 2% on Thursday to around $60.20 a barrel, a four-month low and the fourth consecutive day of decline, as supply concerns weighed on sentiment. OPEC+ is expected to approve a November production increase of up to 500,000 barrels per day, triple the October increase, as Saudi Arabia pushes to regain market share. Meanwhile, signs of oversupply are emerging, with OPEC crude oil production rising last month and Saudi Arabia restoring the first batch of previously suspended supplies, according to a Bloomberg survey. Furthermore, US crude oil and gasoline inventories are rising, and oil exports from Iraqi Kurdistan will resume through Turkey's Kayhan terminal following an agreement to restart flows. Furthermore, risk sentiment has deteriorated further due to the ongoing US government shutdown, with the White House warning of potential large-scale layoffs and no progress on a resolution. Nevertheless, continued purchases by China for its strategic reserve have provided some support.

From a technical perspective, last week's decline after encountering resistance at the 200-day simple moving average near $66.36 was a key trigger for this bearish trend. On Thursday, oil prices briefly hit a 16-week low of $60.20 before recovering, signaling the start of a rebound. The 14-day Relative Strength Index (RSI) is below its midline, and the MACD oscillator remains in negative territory, confirming continued bearish momentum and suggesting significant short-term upward resistance for crude oil prices. On the downside, a break below the $61.10-$61.30 area (near the multi-month low reached on Wednesday) could pave the way for further declines. Subsequently, crude oil prices could test the intermediate support level of $60.40-$60.30, ultimately testing the psychologically important $60.00 swing low reached in late May. On the upside, any attempt to correct through the $61.00 round-figure mark is expected to trigger short-covering, pushing crude oil prices towards the $61.80-$62.50 area.

Consider going long on crude oil at 60.40 today. Stop-loss: 60.25, target: 61.80, 62.00.

Spot Gold

On Thursday, spot gold traded near $3,860/oz, reaching a new all-time high of $3,896.90/oz. Gold prices were boosted by a weakening dollar and safe-haven demand triggered by the US government shutdown. Weak employment data also reinforced market expectations for a Federal Reserve rate cut this month. The US government shutdown has been a key driver of gold's gains this week. Due to partisan disagreements, the White House and Congress failed to reach a funding agreement, and the government largely shut down from midnight on Tuesday, putting thousands of federal jobs at risk. Amidst this geopolitical and policy uncertainty, investors naturally turned to gold as a safe haven, especially in a low interest rate environment, which further enhances its appeal. As the world's reserve currency, the movement of the US dollar directly impacts the appeal of dollar-denominated gold. A depreciating dollar means foreign investors can exchange less of their own currency for more gold.

From a technical perspective, gold bulls have a clear overall near-term advantage. The next ultimate upside price objective for bulls is to push gold prices above the key resistance level of $4,000.00 per ounce. The next near-term downside price objective for bears is to push prices below the key technical support level of $3,750.00 per ounce. First resistance lies at the high of $3,895.20 per ounce earlier this month and the $3,900.00 round-figure mark. Further resistance lies at $3,950.00 per ounce. The ultimate objective is to push gold prices above the key resistance level of $4,000.00 per ounce. First support lies at the low of $3,800.00 per ounce. A clear break below $3,800 would shift the short-term market bias to the bearish side and could pull prices back into the previous consolidation range, which has strong support at the bottom of the $3,750 to $3,700 range.

Consider going long on gold at 3,850 today, with a stop-loss at 3,845 and targets at 3,885 and 3,890.

AUD/USD

The Australian Dollar remained stable against the US Dollar on Thursday, with minor fluctuations, following the release of trade balance data. Traders adopted a cautious stance following the US government shutdown. The Australian Bureau of Statistics reported Thursday that Australia's trade surplus narrowed to A$1.825 billion in August, compared to expectations of A$6.5 billion and the previous reading of A$7.31 billion. Meanwhile, exports fell 7.8% in August, compared to 3.3% the previous month, as gold exports declined after several months of strong growth. Imports rose 3.2% in August, compared to a 1.3% drop in July. The Reserve Bank of Australia (RBA) released its semi-annual financial stability report on Thursday, warning of risks posed by high asset prices and pressures in sovereign debt markets. The report noted that highly leveraged trading and the expansion of the non-bank sector are exacerbating market vulnerabilities. The RBA also warned that weakness in China's real estate sector is putting pressure on banks and is likely to persist.

AUD/USD traded around 0.6600 on Thursday. Technical analysis on the daily chart shows the pair remains within an ascending channel, indicating a bullish bias. Furthermore, the 14-day Relative Strength Index (RSI) is above 50, further reinforcing the bullish bias. On the upside, the pair could test 0.6660 (the high of September 18). A break below this level would target the 12-month high of 0.6707 reached on September 17, followed by the upper line of the ascending channel around 0.6760. Initial support lies at the 20-day simple moving average at 0.6587 and the lower line of the ascending channel around 0.6540. A break below this level would establish a bearish bias and push AUD/USD towards a low near 0.6500.

Consider going long on the Australian dollar at 0.6587 today. Stop-loss: 0.6577. Target: 0.6640, 0.6650.

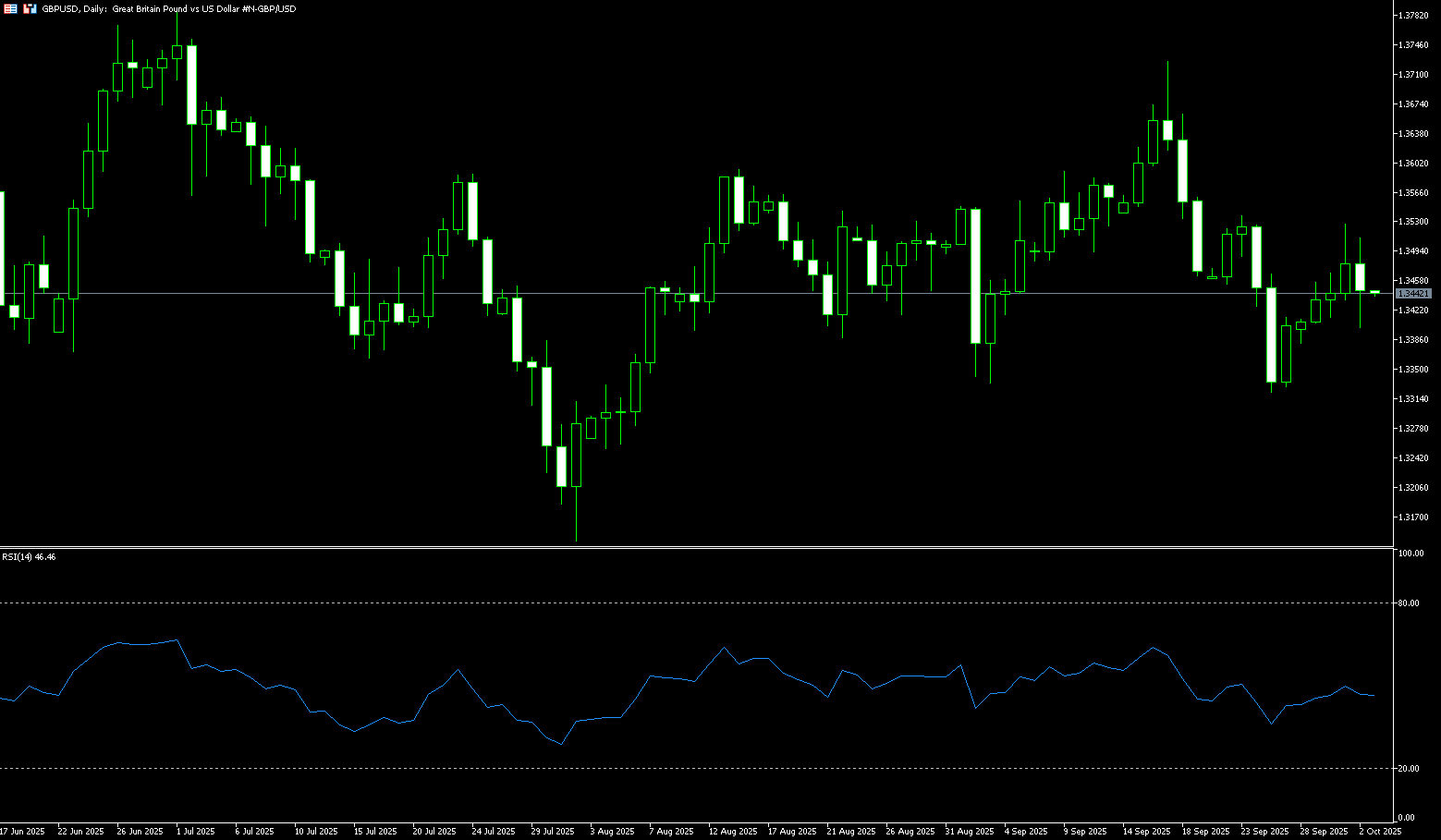

GBP/USD

GBP/USD traded around 1.3450 on Thursday. Further appreciation is possible as the pound sterling received support from cautious comments from Bank of England officials. Bank of England policymaker Kathryn Mann said on Wednesday that the risk of "persistently high" inflation is emerging, highlighting concerns about persistent price pressures. Mann added that keeping interest rates unchanged is appropriate at this time. GBP/USD also found support as the dollar came under pressure following the US government shutdown on Wednesday, after Congress failed to reach a funding agreement. The US non-farm payroll report for September will not be released on Friday, as the Department of Labor has suspended nearly all activities. Wednesday's US ADP employment change report showed a 32,000 decline in private sector payrolls in September, while year-on-year wage growth rose 4.5%.

The daily chart shows that the currency pair is currently under pressure from the 20-day (1.3510) and 30-day (1.3499) simple moving averages, as well as the neckline of the head-and-shoulders bottom pattern. The 14-day relative strength index (RSI) and MACD both indicate that while bears are in the ascendant, the pair is only a hair away from reaching their respective boom-bust lines. Furthermore, 1.3440 was a key level that bulls and bears repeatedly battled for in the past. Currently, the exchange rate is trading above this key level. If it can maintain this level, the next upward targets are 1.3560 (the high of September 19) and 1.3600 (the psychological market level). Conversely, if GBP/USD remains below 1.3464 (the 120-day simple moving average), further downside is expected, with the next areas of focus being the 1.3400 round-number mark and 1.3324 (the low of September 25).

Consider going long on GBP at 1.3430 today. Stop-loss: 1.3420. Target: 1.3480, 1.3500.

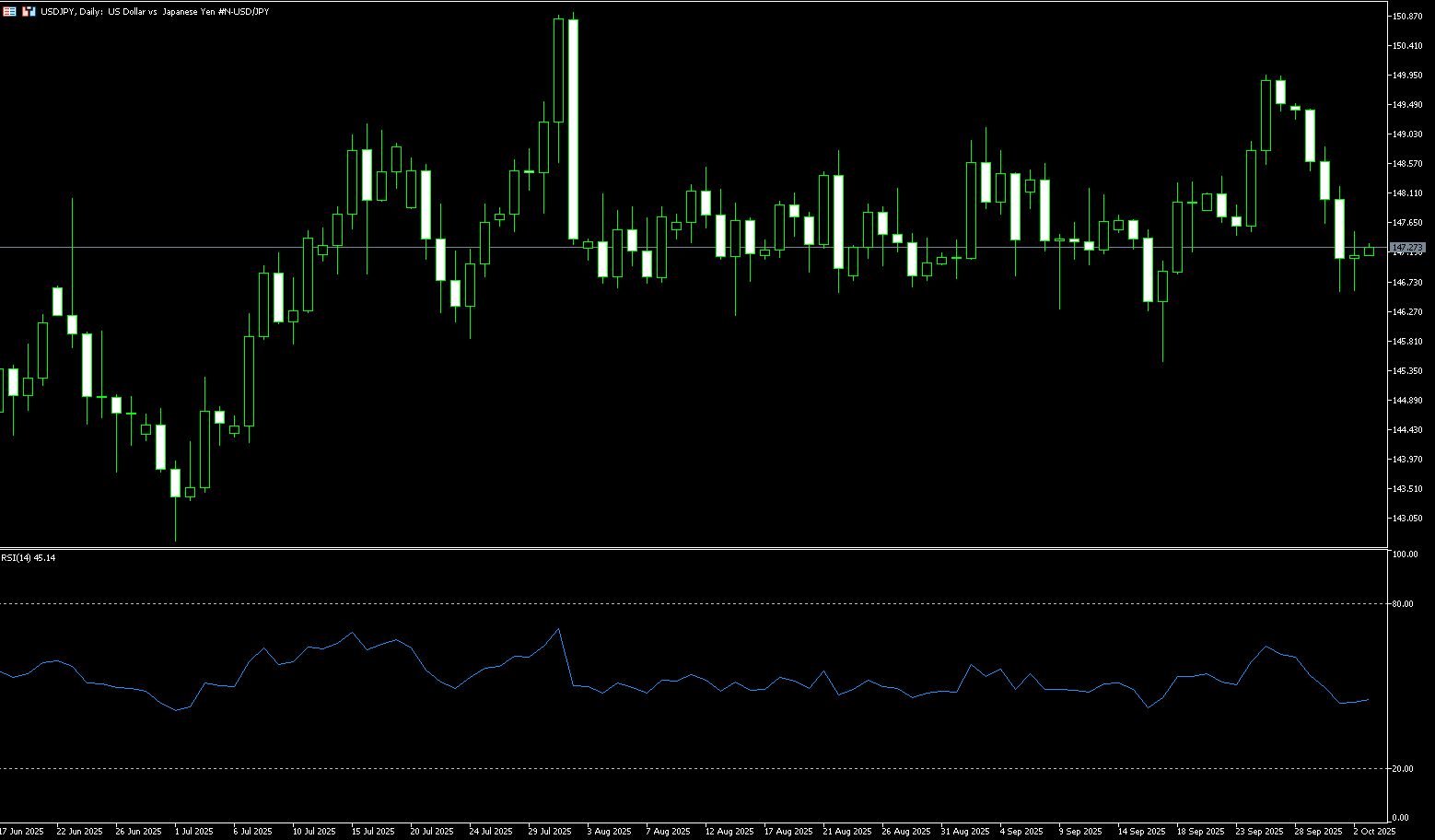

USD/JPY

Ahead of Friday's key non-farm payroll data release, USD/JPY is in a technical consolidation phase. However, the yen's strength and market expectations of a Fed rate cut continue to put pressure on the dollar, and USD/JPY bears are likely to remain dominant. The yen remains strong. After four consecutive trading days of decline to a two-week low, USD/JPY entered a technical consolidation phase on Thursday following its losing streak. However, this short-term consolidation does not affect the overall trend, and bearish sentiment is likely to remain dominant going forward. Weak US jobs data has reignited expectations of a Fed rate cut. Two Bank of Japan policymakers dissented from monetary policy at their latest meeting. Coupled with the resilient tankan survey showing both manufacturing and non-manufacturing sectors, rising market expectations of tightening policy in Japan have further boosted the yen. The market is focusing on Friday's non-farm payroll report for clues on the next move.

Wednesday's break below the 147.00 mark may be seen as a key trigger for USD/JPY bearish sentiment. Furthermore, oscillators on the daily chart have begun to gain negative momentum again, suggesting that the path of least resistance for the spot price remains downward. However, before positioning for further declines, it would be wise to await follow-through selling below the 100-day simple moving average (SMA), currently at 146.50, and Wednesday's low at 146.59. Spot prices could slide towards the 146.00 level, potentially extending to the 145.50-145.45 area, passing through the psychological 145.00 level. On the other hand, the Asian session high, around the 147.30 area, currently appears to be acting as an immediate obstacle. Any further gains could be seen as selling opportunities around the 148.00 level, capped by the 200-day SMA, currently at the 148.28 area. However, a sustained strong break above the latter could trigger short-term selling and push USD/JPY towards the 149.00 round-figure mark.

Consider shorting the US dollar at 147.40 today. Stop loss: 147.60, target: 146.50, 146.30.

EUR/USD

During Thursday's Asian trading session, EUR/USD fluctuated around 1.1720. Concerns about the impact of the US government shutdown weakened support for the pair. Due to the shutdown, weekly US initial jobless claims figures will not be released. The US federal government closed on Wednesday, deadlocked by Congress's failure to reach a funding agreement. The US Supreme Court said Thursday it will hear arguments in January in Trump's attempt to remove Federal Reserve Governor Lisa Cook, temporarily retaining her position. Easing concerns about the Fed's independence could help limit the dollar's losses in the short term. European Central Bank President Christine Lagarde said there are no serious threats to the eurozone's inflation outlook, but officials must remain vigilant. Her comments suggest the ECB is in no rush to further lower borrowing costs. This, in turn, supported the euro against the dollar.

As seen on the daily chart, EUR/USD has remained above 1.1700 for four consecutive trading days, but remains below 1.1778 (midweek high), limiting upward momentum. The 14-day Relative Strength Index (RSI) has plateaued near the neutral 50 level, suggesting indecision. A break above 1.1778 would expose psychological resistance at 1.1800, followed by the year-to-date high of 1.1918. On the downside, a break below the 1.1700 round-figure mark would target support at 1.1650 (89-day simple moving average), before testing the 1.1600 round-figure mark and the key support of the 100-day simple moving average at 1.1610.

Today, consider going long on the Euro at 1.1710, with a stop-loss at 1.1700 and a target of 1.1760 or 1.1770.

Disclaimer: The information contained herein (1) is proprietary to BCR and/or its content providers; (2) may not be copied or distributed; (3) is not warranted to be accurate, complete or timely; and, (4) does not constitute advice or a recommendation by BCR or its content providers in respect of the investment in financial instruments. Neither BCR or its content providers are responsible for any damages or losses arising from any use of this information. Past performance is no guarantee of future results.

More Coverage

Risk Disclosure:Derivatives are traded over-the-counter on margin, which means they carry a high level of risk and there is a possibility you could lose all of your investment. These products are not suitable for all investors. Please ensure you fully understand the risks and carefully consider your financial situation and trading experience before trading. Seek independent financial advice if necessary before opening an account with BCR.